Credit Union Mergers: Maximizing Benefits & Best Practices

You have a lot to celebrate when you’ve created a credit union that is successful enough to be sought after by larger financial institutions. All of your hard work and due diligence can pay great dividends in the… Read More

Optimizing Credit Union Financial Health & Avoiding Merger Pitfalls

The word “merger” can incite a variety of feelings, emotions, and opinions from credit union leaders. Ideally, credit union board and executive team members have steadily been working to build an organization which is financially healthy and contributes… Read More

Credit Union Merger Approvals – April 2016

Mergers approvals were down slightly in April. NCUA approved 20 mergers in April 2016 which are down from 23 last month. The number of mergers are down and the combined assets of merged credit unions are also down… Read More

Credit Union Mergers: Celebrating the Success!

For many business leaders, part of the American Dream is creating a company that is so successful it will one day be sold to a larger entity. While this goal is seen as part of a strategic investment… Read More

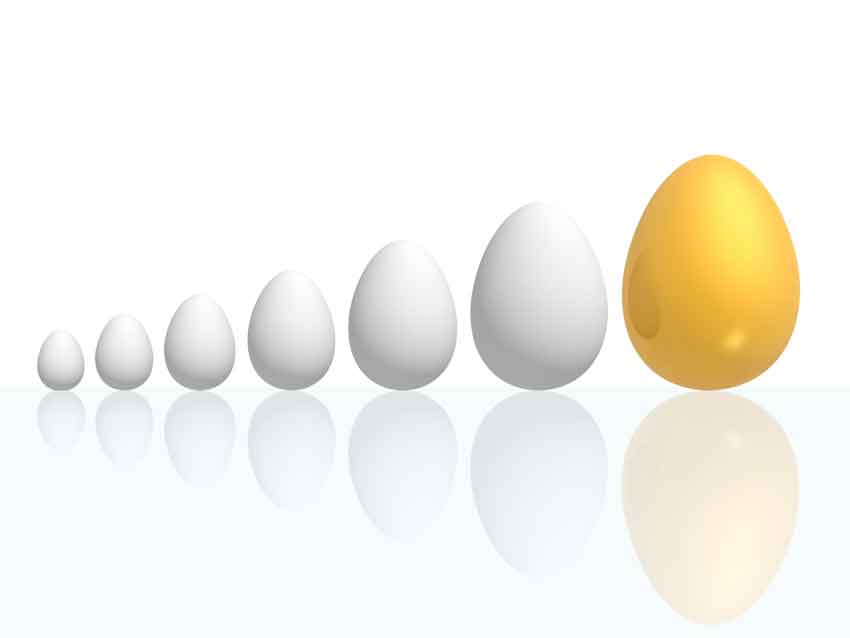

The Big Get Bigger

In a tumultuous digital financial landscape, today’s credit unions are better positioned than ever before. Memberships are on the rise as more and more individuals seek alternatives to the traditional, monolithic banking institutions of the past. Credit unions… Read More

Growth Is Costing Small Credit Unions A Marketing Fortune

The year 2014 was historic for membership growth. For the first time in the history of the movement, credit unions surpassed the 100 million mark in total membership. From a macroscopic perspective, our industry is on a roll…. Read More

Credit Union Merger Approvals – March 2016

Mergers approvals picked up in March. NCUA approved 23 mergers in March 2016 which is the highest approval rate so far this year. March credit union merger approvals is nearly twice the number of mergers from March of… Read More

Credit Union Merger Approvals – February 2016

Mergers approvals are off to a slow start this year. The NCUA approved 15 mergers in February 2016 which is equal to the number of approvals from last month. Although a fairly low approval number it is nearly twice… Read More

Small Credit Unions Feeling Squeezed By Compliance Costs

In the world of financial services, modifications to regulatory governance can change rapidly. In fact, some would argue that each new day in the credit union business brings brand new changes that alter the industry from the way… Read More

Credit Union Merger Approvals – January 2016

To begin the year NCUA approved 15 mergers in January 2016, which is down from the 20 mergers in December and 19 in January of last year. The combined assets of merged credit unions is down nearly $190… Read More

7 Teams For Your Credit Union Merger

The credit union merger process is relatively complex and needs careful management to ensure a successful outcome. Apart from the merger team that oversees the entire process, a number of subsidiary teams are needed, each handling a different… Read More

Credit Union Merger Approvals – November 2015

Similar to last month the NCUA approved 19 mergers in November 2015, which is down from the 22 mergers in October of last year. The combined assets of merged credit unions is up nearly $50 million compared to… Read More

Is the Compliance Burden Driving your Credit Union to Consider a Merger?

If you’re a leader in your credit union, compliance is certainly not a new issue. The compliance burden of today’s market is significant and costly; nor will it go away any time soon. If you feel like you… Read More

7 Elements of a Strategic Growth Plan

Strategic organizational growth doesn’t happen by accident, or without plenty of care and nurturing. This is especially true with credit unions, where members benefit from growth, not third-party stockholders. Creating an intentional and forward-thinking strategic growth plan is… Read More

NCUA Approves 19 Mergers in October

The number of mergers is down compared to last month and year. The NCUA approved 19 mergers in October 2015, which is down from the 28 mergers last month and 28 in October of last year. The combined… Read More

Merger Success Begins with Soft Side Due Diligence

Credit union mergers are beneficial not only for the acquiring institution, but also for the institution being acquired, and the members and employees of both. Unlike many other business consolidations, credit union mergers produce positive results for all… Read More

Credit Union Merger Approvals September 2015

The number of mergers is up compared to last month and year. The NCUA approved 28 mergers in September 2015, which is up from the 16 mergers last month and 20 in September of last year. The combined… Read More

3 Ways a Merger Can Help Your Credit Union Capture More Business

An economic research by the Federal Reserve Bank of San Francisco published in September, 2011 shows that in 1969, when there were 23,866 credit unions in the U.S.A., these unions’ assets totaled $16 billion. This was equivalent to… Read More

CEO Advisory Group

CEO Advisory Group