Bank Acquisition Momentum Builds: San Francisco FCU’s Summit Bank Deal Signals Continued Growth Trend

The credit union industry continues to embrace bank acquisitions as a strategic growth pathway, with the recent announcement by $1.3 billion San Francisco Federal Credit Union to acquire $4.5 million Summit Bank serving as the latest example of… Read More

Credit Unions Must Evolve to Thrive

Any credit union using yesterday’s business practices to operate in today’s fast-paced business environment will struggle to survive into the future. The best-performing credit unions have consistently reinvented themselves to keep pace with the evolving financial services landscape—defined… Read More

More Mergers Occurring For Strategic Reasons Rather Than Financial Distress

While mergers continue unabated in the credit union industry, the reasons for undertaking them has shifted over the years. As we reported in our 2019 white paper, “When Prospective Partners Come Calling,” most mergers in the past occurred… Read More

What Should You Be Looking for in a Successor CEO?

Succession planning is getting considerable attention in 2025, as the deadline draws nearer to the NCUA final rule requiring that federally insured credit unions have a written plan. With just a few months until the Jan. 1, 2026,… Read More

In Prioritizing Succession Planning, Credit Unions May Also Wish to Consider Mergers

Succession planning has been a hot topic in the credit union space over the last several years, fueled in part by the National Credit Union Association’s rule that requires federal credit unions to establish a formalized succession planning… Read More

Three Pathways for Credit Unions to Achieve Scale

Scale is one of the hottest topics in credit union operations these days. With the rising cost of technology, operations, talent acquisition, and other business functions, the need for credit unions to become simultaneously bigger and more efficient… Read More

Credit Union Mergers Analysis: First Quarter 2025

An analysis of credit union mergers for the first quarter of 2025 shows quarterly fluctuation in the number of approved transactions, with a slight decrease in merger approvals and the combined asset size of merging institutions. Looking at… Read More

CEO Advisory Group Facilitates Strategic Acquisition

Frontier Credit Union to Acquire First Citizens Bank of Butte CEO Advisory Group is pleased to announce our role as financial advisor to Frontier Credit Union in its strategic acquisition of First Citizens Bank of Butte, a transaction… Read More

Credit Unions Find Viable Growth Path with Bank Acquisitions

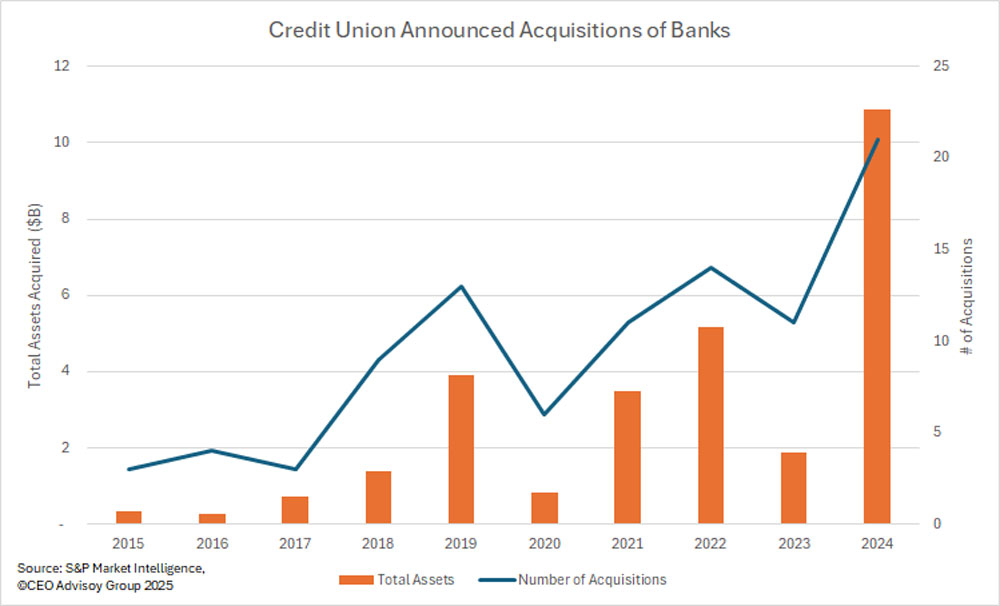

For decades, credit unions and banks experienced no crossover in their merger and acquisition strategies. Credit unions merged with other credit unions, banks acquired other banks, and neither the twain did meet. All of that began to change… Read More

Bank Acquisition Boom: How Credit Unions Are Changing the M&A Landscape

CEO Advisory Group Releases New Whitepaper: “What Credit Unions Need to Know About Bank Acquisitions” First installment of three-part series provides strategic guidance on an increasingly important growth strategy LAKE TAPPS, WASHINGTON – CEO Advisory Group, a leading… Read More

NCUA Final Succession Planning Rule Explained

In December, the NCUA approved its final credit union successional planning rule, which requires federally insured credit union boards to establish succession planning processes for key positions and will go into effect on Jan. 1, 2026. The final… Read More

Credit Union Merger Approvals Q3 2024

An analysis of credit union mergers for the third quarter of 2024 shows an upward trend in both the number of approved transactions and the combined asset size of the merging institutions. The latter trend is being driven… Read More

Credit Union Merger Approvals 2Q 2024

NCUA approved 46 mergers in Q2 of 2024 which increased from 26 last quarter. The combined assets of merged credit unions total $3.3B, which compares to $3.7B last quarter and $2.7B in Q2 2023. The mean and median… Read More

Careful Planning is Essential to Successfully Executing a Merger with Another Credit Union

Difficult economic conditions, increased funding costs and competition from larger institutions will continue to drive credit unions to combine to sharpen their competitive edge. The number of mergers of credit unions with assets of $500 million and above… Read More

CEO Advisory Group is Consultant to HVCU in Proposed Bank Acquisition

Hudson Valley Credit Union, headquartered in Poughkeepsie, New York, entered into a definitive agreement to acquire Kingston, New York based Catskill Hudson Bank on January 10th, 2024. Founded in 1963, Hudson Valley Credit Union, serves more than 350,000… Read More

How the Demand for Tech Talent Complicates Succession Planning

Succession planning for credit unions has become more complex these days because of the rapidly evolving skills required to run a financial institution. The rise of fintechs has changed the competitive landscape, making investment in technology—and the talent… Read More

Credit Union Merger Approvals 3Q 2023

NCUA approved 39 mergers in Q2 of 2023 which increased from 36 last quarter. The combined assets of merged credit unions totals $946M, which compares to $2.7B last quarter and $3.5B in Q3 2022. The mean and median… Read More

How Mergers Can Build the Talent Pipeline

Where will your future leaders come from? The question has taken on greater urgency in today’s quickly changing workforce. CEOs are retiring at an unprecedented rate, fueled by the demographic reality of 10,000 baby boomers turning 65 every… Read More

Why Credit Unions Are Acquiring Banks at a Record Pace

When credit unions look for merger partners, they increasingly are considering banks. S&P Global reports that credit unions entered into a record number of bank acquisitions in 2022. There were 14 acquisitions for the year, surpassing the previous… Read More

Two Key Issues for Boards: Succession Planning and Merger Considerations

by Teresa Freeborn, Guest Writer Board succession planning is as important as executive succession planning, but often it’s simply not done because it’s not perceived to be urgent. Some board members seem to view their role as a… Read More

CEO Advisory Group

CEO Advisory Group