Credit Union Merger Analysis: Third Quarter 2025

An analysis of credit union mergers for the third quarter of 2025 shows relatively consistent merger volumes compared to the first and second quarters, but a dramatic increase in the combined asset size of the acquired institutions.

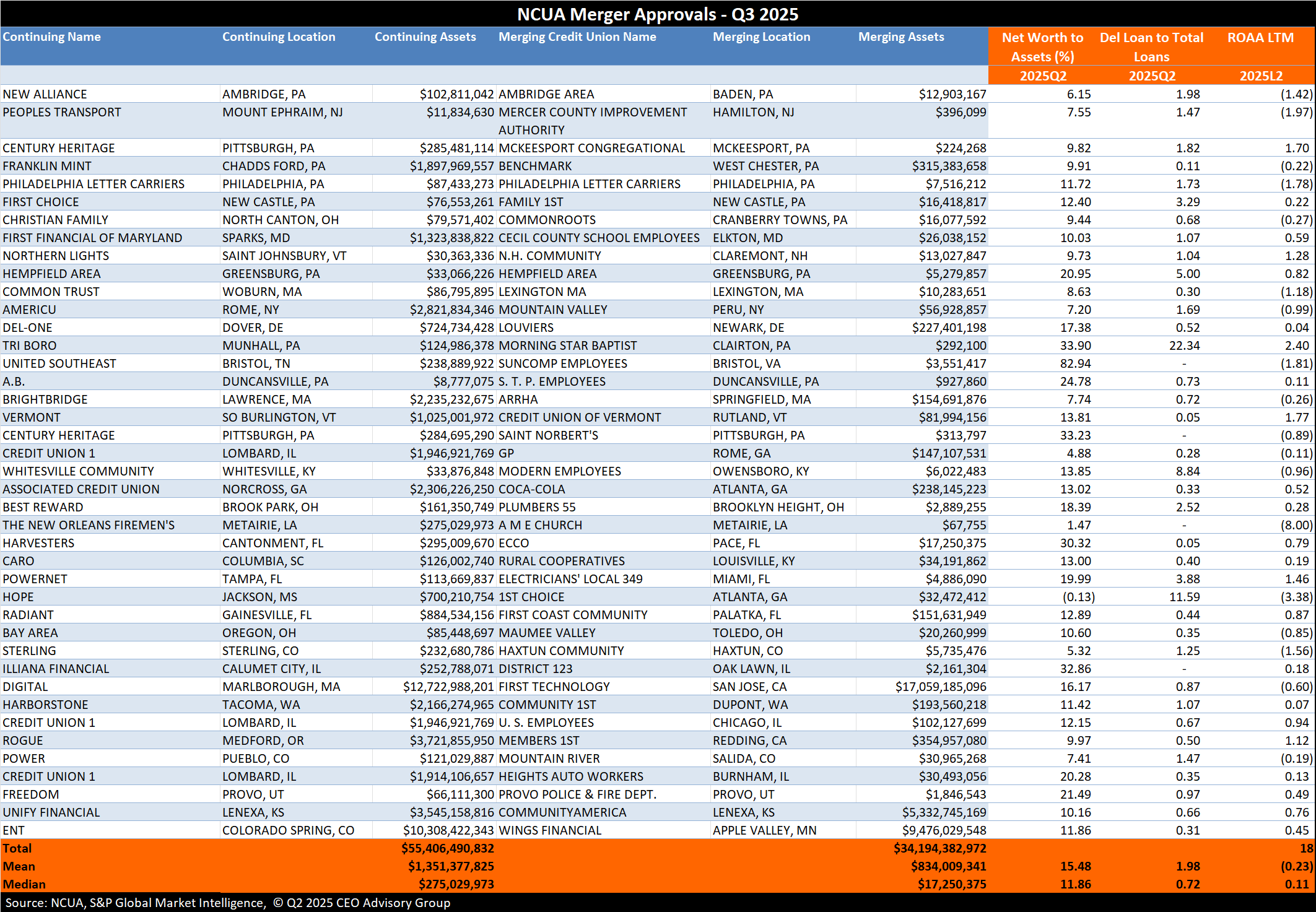

The NCUA approved 41 mergers in Q3 2025, up from the 35 mergers in Q1 but down from the 45 mergers that occurred last quarter. However, the combined assets of merged credit unions total $34 billion, compared to $5.6 billion in Q2 and $2.4 billion in Q1. The mean and median assets of merged credit unions are $834 million and $17 million, respectively.

With 80 mergers to date in 2025, credit union mergers are trending down compared to 2024, which had a total of 121 mergers by this time last year. But again, the total assets acquired tell a different story. From 2022 through 2024, the total assets acquired in all mergers were $35 billion, just over the total from quarter 3 of this year.

Large Credit Union Acquirers

There were three very large mergers-of-equals among credit unions this quarter. $17 billion First Technology Credit Union, San Jose, California, merged into $12.7 billion Digital Credit Union, Marlborough, Massachusetts. In Lenexa, Kansas, $5.3 billion CommunityAmerica Credit Union merged into $3.5 billion Unify Financial Credit Union. Also $9.5 billion Wings Financial Credit Union, Apple Valley, Minnesota, merged with $10.3 billion Ent Credit Union, Colorado Springs, Colorado. Our whitepaper “Strategic Succession – The Case for Merger-Driven CEO Transitions” provides insights into the consolidation of ever larger credit unions.

The median asset size of the continuing credit unions is $275 million, and the mean is $1.3 billion. Fourteen of the acquiring credit unions have assets exceeding $1 billion. Combined, the acquiring credit unions had $55.4 billion in assets.

At the other end of the spectrum, there are six credit union acquirers with assets below $1 million for Q3, and five had assets greater than $250 million. The acquired credit unions have a median of $17 million in assets and a mean of $834 million. The smallest credit union merger partner is A M E Church Credit Union in Metairie, Louisiana, with assets of $67,755.

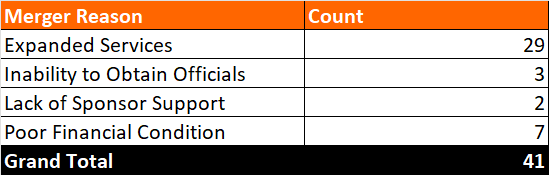

Reasons for Credit Union Mergers

When seeking regulatory approval, credit unions are required to cite the reason for the merger. As shown in the chart below, 29 of the 41 transactions listed expanded services as the reason for the merger. However, 17% cited poor financial condition.

The financial performance of the acquired credit unions could be characterized as mixed. The median net worth ratio of the merging credit unions is 11.86%, indicating good capitalization. However, five credit unions have net worth ratios below 7.0%, which is considered undercapitalized.

Other financial performance indicators present a similarly mixed view. The delinquent loans-to-total loans ratio averages 1.98%. The mean return-on-assets (ROA) was negative 0.23% in the last 12 months, and the median was 0.11%. More concerning was that almost half of the merging credit unions (18 out of 41) reported negative earnings in the last 12 months.

Below is a chart of the NCUA merger approvals for Q3 2025:

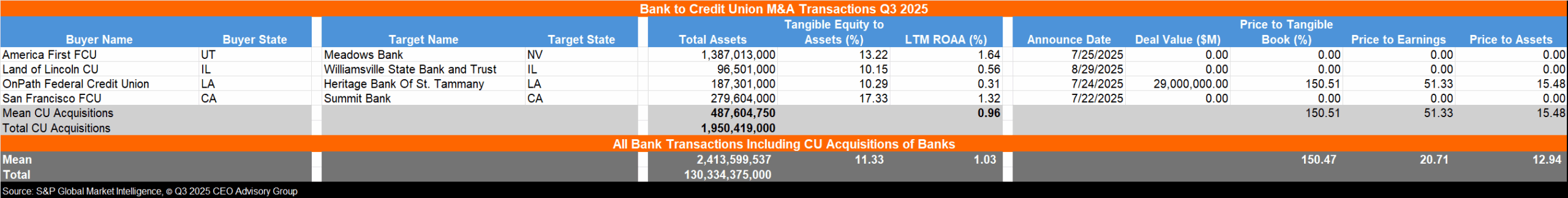

Credit Union Acquisitions of Banks

Bank consolidation proceeded at a faster pace than credit union mergers, with a total of 52 bank acquisitions announced in the third quarter of 2025, a four-year high. The total deal value of $16.63 billion is also the largest since Q4 2021. During this time, credit unions acquired four banks. In total, the banks being acquired by credit unions had assets of $1.9 billion, up slightly from $1.5 billion acquired in bank-to-credit-union mergers in the second quarter.

In Nevada, $1.4 billion Meadows Bank was acquired by $23 billion America First Federal Credit Union, Riverdale, Utah. This was the largest bank acquired by a credit union last quarter. The smallest was $96.5 million Williamsville State Bank and Trust, Springfield, Illinois, purchased by $475 million Land of Lincoln Credit Union, Decatur, Illinois.

The deal terms were announced in just one credit union bank acquisition, with OnPath Federal Credit Union, Metairie, Louisiana, acquiring $187 million Heritage Bank of St. Tammany, Covington, Louisiana, for a price to tangible book of 150.51%. The acquisition brings OnPath FCU’s assets to $1.3 billion. Among all bank acquisitions reporting deal terms, the average price/tangible book was 148%.

For all banks acquired by credit unions, the average ROAA was 1.03%.

Following is a deal summary of the credit union acquisitions of banks and a summary of all bank transactions:

CEO Advisory Group

CEO Advisory Group