Credit Unions Must Evolve to Thrive

Any credit union using yesterday’s business practices to operate in today’s fast-paced business environment will struggle to survive into the future. The best-performing credit unions have consistently reinvented themselves to keep pace with the evolving financial services landscape—defined now by artificial intelligence, increased competition, changing consumer expectations, and shifting demographics. This changing environment and requirements this has on future leadership characteristics will have profound impacts on succession planning. Mergers are likely to become an ever-increasing component of the succession plan in order to gain competitive advantage. Succession Planning with Mergers as an Option explores this topic in depth.

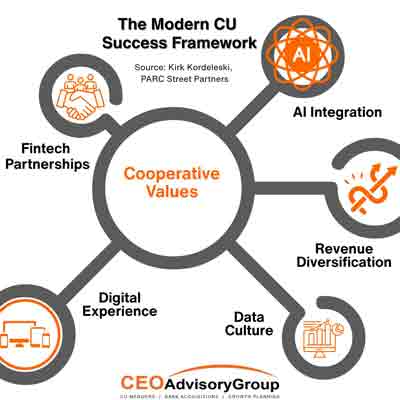

Kirk Kordeleski, executive compensation and strategy consultant for PARC Street Partners and former CEO of Bethpage Federal Credit Union, has studied the evolution of credit unions extensively and has pinpointed key shifts in the business model prompted by seismic changes in technology, competitive forces, and consumer behaviors.

“I think we’re in a fifth—and rapidly moving toward a sixth—generation of the credit union business model and leadership approach,” Kordeleski says. “While previous generations had limited competition, often serving a select employer or local community, today’s credit unions must compete on a national and even digital stage. The competition now includes fintechs, neobanks, global platforms, and embedded finance models.”

Generations 1 Through 4: The Roots of the Movement

The first generation of credit unions emerged in the 1930s, offering basic consumer loans and savings vehicles to members of a specific employer group. These volunteer-led organizations met basic needs for financial inclusion.

The second generation, beginning in the 1950s, expanded offerings to include auto loans and small home improvement financing. Still operating lean, these credit unions focused on meeting the borrowing needs of middle-income America.

In the 1970s, the third generation brought greater sophistication—adding mortgage lending, certificates of deposit, and serving multiple SEGs (select employee groups).

The fourth generation began in the late 1990s and 2000s, as many credit unions transitioned from SEG to community charters and invested in branch networks, ATMs, and early online banking tools to enhance member convenience.

Fifth Generation: Digital and Data-Driven Transformation

The fifth generation, now in full swing, marks a transformation driven by data and digital infrastructure. This era—catalyzed by the pandemic—ushered in a new member experience model emphasizing mobile-first design, 24/7 digital engagement, and frictionless service.

“Leadership styles as well as strategic planning have evolved dramatically,” Kordeleski says. “Today’s leaders must be fluent in digital strategy, data analytics, brand architecture, and financial discipline. They must understand margin compression, deposit volatility, interest rate sensitivity—and lead with agility across all of it.”

Key enablers of success in this generation include:

- AI integration in fraud detection, underwriting, and member service

- Fintech partnerships to accelerate innovation and plug service gaps

- Increased emphasis on member experience design and analytics

- Digital lending platforms replacing traditional workflows

- Regulatory scrutiny, especially around liquidity, DEI, and cybersecurity

Credit unions that fail to develop a data-informed culture, modernize their core systems, or diversify their revenue streams are at risk of being acquired or becoming irrelevant.

The Sixth Generation: Purpose-Driven Platforms with Personalized Finance

A new generation is emerging—what some are calling “CU 6.0”—centered around hyper-personalization, platform integration, and purpose-driven banking. The sixth generation credit union may look more like a fintech: leaner, faster, and digital at its core—but grounded in cooperative values and financial well-being.

We’re seeing the rise of digital-first institutions, embedded banking partnerships, and white-labeled wealth and investing tools for members of all income levels. Credit unions are exploring AI not just for automation, but for delivering individualized financial coaching at scale.

Despite these advances, successful credit unions will preserve the very qualities that have made them unique for nearly a century: member focus, community engagement, and long-term value over short-term profit.

Veteran credit union leader Teresa Freeborn remains optimistic. “I’m seeing small and feisty credit unions respond to intense competition by doubling down on what only credit unions can do—serving underserved niches and offering authentic financial relationships,” says Freeborn, author of Suits and Skirts: Game On!

As an example, Freeborn points to South Bay Credit Union’s launch of Emerald Beach Financial, a subsidiary focused on banking for cannabis entrepreneurs—an underserved and fast-growing market.

Similar stories are unfolding across the country, where credit unions are innovating in solar lending, bilingual financial coaching, or student loan assistance—offering what big banks overlook and fintechs can’t fully deliver: trust, empathy, and local relevance.

To learn more about how today’s credit unions are managing leadership transitions in the face of rapid evolution, download the CEO Advisory Group’s white paper: Succession Planning with an Eye Toward Mergers as an Option, featuring insights from Kordeleski, Freeborn, and five other experts on what’s next for the credit union movement.

CEO Advisory Group

CEO Advisory Group