Credit Union Merger Approvals Q3 2024

An analysis of credit union mergers for the third quarter of 2024 shows an upward trend in both the number of approved transactions and the combined asset size of the merging institutions. The latter trend is being driven by several large credit union acquirers with assets topping $1 billion.

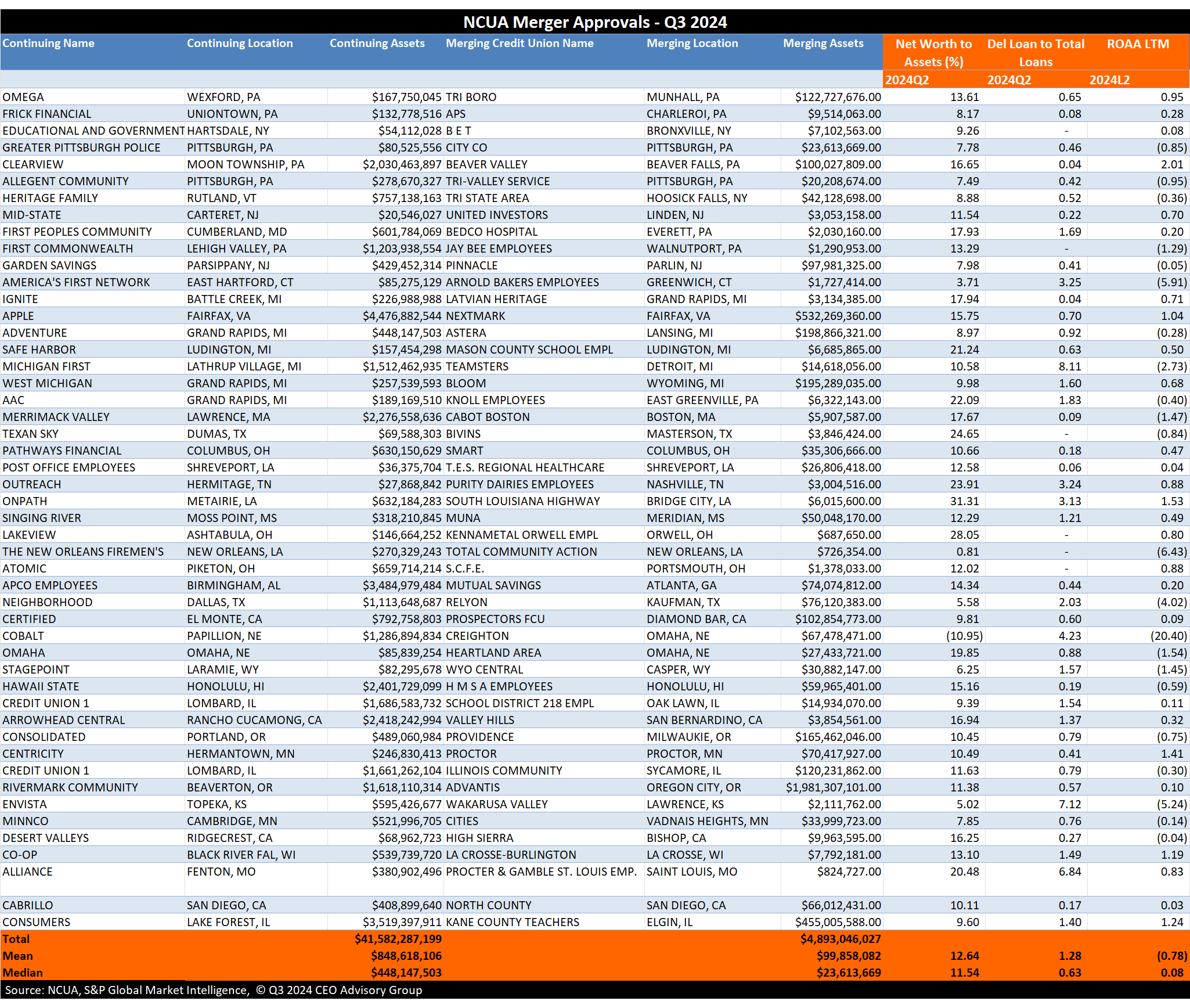

The NCUA approved 49 mergers in Q3 2024, an increase from the 46 mergers that occurred in the previous quarter. The combined assets of merged credit unions total $4.9 billion, which compares to $3.3 billion last quarter and $946 million in Q3 2023. The mean and median assets of merged credit unions are $99.9 million and $23.6 million, respectively.

LARGE CREDIT UNION MERGERS

There were three acquisitions of credit unions with assets exceeding $250 million this quarter. The largest acquisition occurred between two Oregon credit unions, both exceeding $1 billion in assets. This merger of $2 billion Advantis Credit Union, located in Oregon City, into the slightly smaller $1.6 billion Rivermark Credit Union in Beaverton has created the second largest credit union in the state. Leading up to the merger, Advantis CU had an 11.4% net worth ratio, 0.56% delinquent loan ratio, and 0.1% ROAA LTM.

Rivermark Credit Union is far from alone in being a billion-dollar-plus acquirer this quarter. There are 14 credit union acquirers with assets exceeding $1 billion. With $4.7 billion in assets, Virginia Credit Union is the largest acquiring credit union in Q3.

On the other side of the spectrum, there are 10 credit union acquirers with assets below $100 million for Q3. The inclusion of these smaller institutions lowered the median size of all acquiring credit unions to $448 million for the quarter.

The acquired credit unions on average represent 11.8% of the assets of the acquiring credit unions. There are three credit unions with less than $1 million in assets being acquired. The smallest credit union merger partner is Kennametal Orwell Credit Union, based in Orwell, Ohio, with assets of $688,000.

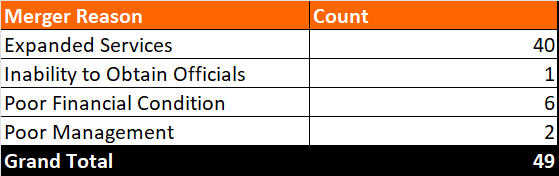

REASONS FOR CREDIT UNION MERGERS

When seeking regulatory approval, credit unions are required to cite the reason for the merger. As shown in the chart below, 40 of the Q3 transactions listed expanded services as the reason for the merger. However, 1 in 6 cited poor financial condition or poor management.

The financial performance of the acquired credit unions could be characterized as mixed. The median net worth ratio of the merging credit unions is 10.6%, indicating good capitalization. However, there are eight credit unions that have net worth ratios below 7.0%, which is considered undercapitalized.

Other financial performance indicators present a similarly mixed view. The delinquent loans-to-total loans ratio averages 1.3%. The mean return-on-assets (ROA) was 0.78% in the last 12 months, but the median was only 0.08%. More concerning was that nearly half of the 49 merging credit unions—a total of 22—reported negative earnings in the last 12 months.

Below is a chart of the NCUA merger approvals for Q3 2024:

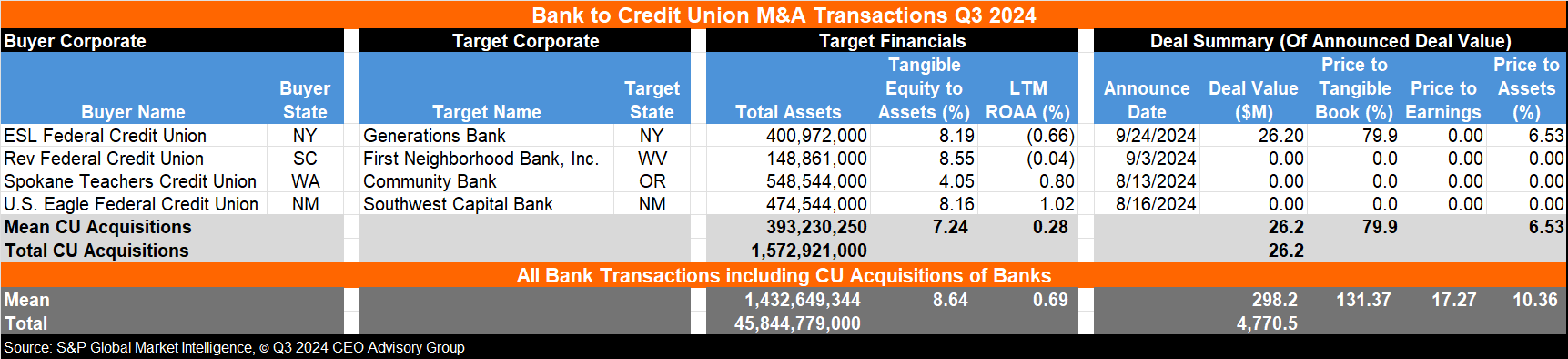

CREDIT UNION ACQUISITIONS OF BANKS

Bank consolidation proceeded at a slightly slower pace than credit union mergers, with a total of 32 whole bank acquisitions announced in the third quarter of 2024. Credit unions are the acquirers in four of these announced bank acquisitions. In total, the banks being acquired had assets of $1.8 billion, which represents 33% of the combined assets that credit unions acquired in credit union to credit union mergers in the third quarter.

Only one credit union announced the terms of the deal. In September 2024, ESL FCU announced the acquisition of Generations Bank, with $401 million in assets. The transaction was reported with a price/tangible book of 80%, according to S&P Global Market Intelligence. Among all bank acquisitions reporting deal terms, the price/tangible book was 131%.

For all acquired banks, the average ROAA was 0.69% with only four reporting a negative ROAA the last 12 months before the announced M&A transaction.

Following is a deal summary of the credit union acquisitions of banks and a summary of all bank transactions:

CEO Advisory Group

CEO Advisory Group