6 Growth Strategies for Small & Medium Credit Unions

Sustained growth can seem insurmountable as a small credit union or medium-sized credit union in a large market.

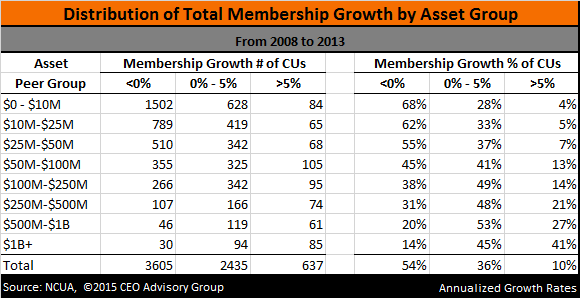

Nearly 80% of industry membership growth is attributed to the 435 credit unions with over $500 million in assets according to a CEO Advisory Group growth study. This study, which spanned the five year period 2008 to 2013, identified credit union peer groups below $50 million having declining membership growth in aggregate. As shown in the table below, over half the credit unions in peer groups below $50 million had negative membership growth.

Growth has indeed been difficult to achieve for smaller credit unions. Yet despite a difficult operating and competitive environment a number of credit unions have found strategies to successfully grow. So what are some of the strategies your credit union can employ as a small credit union to fuel member, loan and share growth?

1. Refresh Strategic Plan

Business strategies become outdated and need to be updated to by taking an honest evaluation of the situation.

A good start is to examine the membership base.

Is the field of membership expanding or contracting? Do you have the ability to grow market share or is it stagnant/declining?

Many credit unions are struggling as the sponsors have downsized or their communities have been burdened by longstanding recession.

Successful credit unions are often able to ride the coattails of an expanding economy as opposed to fighting furiously for fractional improvements for market share in a declining market base.

A thorough examination of the current and projected market prospects will help guide your decision in where to make strategic resource allocations.

For many smaller credit unions the focus will need to be on specific market niches with good growth prospects where they can make a difference.

2. Assess the Value Proposition

Demographics and technology have combined to alter consumer expectations for financial services. Friendly tellers and a branch near your sponsor’s headquarters location just isn’t enough to sustain a credit union for the long run. And the “great rate” perception credit unions have worked so hard to attain may no longer be viable with large credit union competitors and non-banks entering your market space.

As a boutique credit union you cannot be all things to all people. Focus is critical. Align your products, delivery, and marketing in a way that the brand resonates with the market niche.

3. Enhance Your Facilities

Are your branches looking tired? Has it been years since they were last updated?

Revitalizing your branch can often spur new growth. Your branch serves as a billboard to members and prospective members. The branch exterior and interior are “moments of truth” in the member experience.

A branch audit is a good first step to begin prioritizing the resource allocation for your branches. This audit can include an assessment of the location or whether the credit union would be better served by relocating the branch to a different market or a more favorable location within the existing market.

4. Enhance Your Online Presence

It is no longer adequate to mark off on the checklist that you have a website, home banking, and bill payment and feel like you’re done.

A credit union’s online presence must meet the demanding expectations of members young and old. Increasingly members research their products and services online. If your site does not deliver, members will go elsewhere. Credit union executives must now become usability experts. The online and mobile customer experience is critical.

Establish very clear goals for what you want your web/mobile presence to accomplish. Begin tracking and rewarding on the basis of goals attained. Your credit union needs to understand the sales funnel and how members track through the different stages of the purchase journey.

5. Embrace Digital Marketing

Digital marketing is in many ways a chance for smaller credit unions to level the playing field. While it may be cost prohibitive to open new branches, digital marketing enables credit unions to enhance brand awareness within a targeted segment of the market.

Social media, remarketing, targeted ads, and marketing automation all provide opportunities for credit unions willing to invest resources and develop expertise.

6. Mergers

Credit unions are increasingly looking for strategic mergers as a pathway to growth. Partnering with another credit union can enhance the competitiveness of both credit unions. Your credit union may consider merging with another credit union in the same market to build market share and efficiency. Alternatively, you may consider a merger with a credit union in an adjoining market to achieve a larger footprint. Out of state mergers have also become more prevalent, and bring with it other benefits.

The merger options include merging in a smaller credit union, a merger of equals and merging into a larger credit union. Credit unions should evaluate the options using a systematic approach in an effort to reduce the “merger emotions”. The assessment should consider the impact of each decision on members, employees, community and credit union financial performance.

While growth may be hard to generate for many small and medium credit unions there continue to be opportunities.

Reinvesting in growth is critical for not only surviving by thriving. While there may be comfort in staying the course and seeing the net worth ratio grow into the high teens and twenties, the long term success of your credit union is predicated on wise allocation of resources for future growth.

CEO Advisory Group

CEO Advisory Group