Credit Union Merger Approvals Up Slightly in March

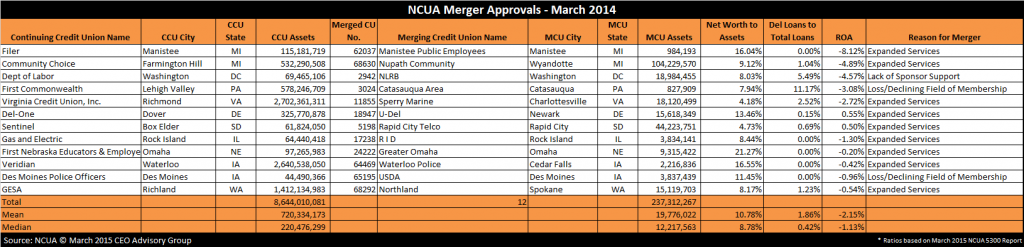

The NCUA approved 12 mergers in March 2015 which is down from the 22 mergers in March of last year.

The combined assets of the merged credit unions are $237 million. The mean and median assets of merged credit unions are $19.8 million and $12.2 million respectively. In contrast, last month the mean assets were $26 million.

Large Credit Union Mergers

There was one merger with a credit union exceeding $50 million in assets.

Farmington Hill, MI based Community Choice Credit Union ($532M) acquired Nupath Community Credit Union ($104M) located in Wyandotte, MI. Expanded services was cited as the reason for the merger. Nupath had good net worth (9.1% of assets) but a poor return on assets (-4.9%).

Credit Union Merger Stats

The median size of acquiring credit unions is $220 million. There were three credit union acquirers with assets exceeding $1 billion. With $2.7 billion in assets Virginia Credit Union, Inc., based in Richmond, VA was the largest acquiring credit union in March merging Sperry Marine CU. Waterloo-based Veridian CU, which is merging Cedar Falls, IA based Waterloo Police CU with $2.2 million in assets, was the second largest acquirer with $2.6 billion in assets.

The acquired credit unions on average represented only 3% of the assets of the acquiring credit unions. There was one merger where the relative size between the merged and continuing credit unions would be considered a merger of equals. In South Dakota, Rapid City Telco CU, with $44.2 million in assets, represented 72% of Sentinel CU’s $61.8 million assets.

Two credit unions with less than $1 million in assets are being acquired. The smallest credit union is Catasauqua Area CU based in Catasauqua, PA with $828,000 in assets, which is being acquired by $578.2 million First Commonwealth CU.

Reasons for Credit Union Mergers

“Expanded services” continues to be the primary factor motivating these mergers. “Loss/Declining field of membership” was the reason for the merger sited by two of the credit unions. “Lack of sponsor support” was also cited as a reason for the merger.

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 8.8%. Two credit unions have net worth ratios below 7.0%.

The delinquent loans-to-total loans ratio averages 1.9%, which is primarily attributed to one credit union with delinquency ratios exceeding 10% of loans. This includes the 11% delinquency ratio reported by Catasauqua Area CU.

Only two of the 12 credit unions have positive earnings year to date. Consequently the mean return-on-assets (ROA) is -2.2% through March of this year.

Below is a chart of the NCUA merger approvals for March 2015:

CEO Advisory Group

CEO Advisory Group