Credit Union Mergers Analysis: Second Quarter 2025

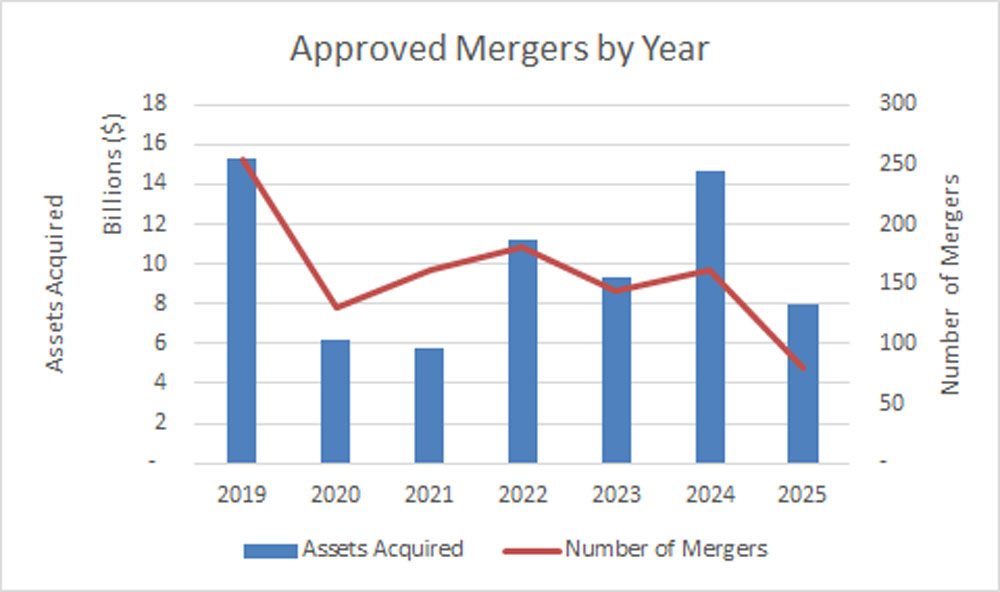

An analysis of credit union mergers for the second quarter of 2025 shows an upward trend over the first quarter in both the number of approved transactions and the combined asset size of the merging institutions.

The NCUA approved 45 mergers in Q2 2025, up from the 35 mergers that occurred in the previous quarter. The combined assets of merged credit unions total $5.6 billion, more than double the $2.4 billion in Q1 and nearly double the $3.3 billion approved mergers during last year’s second quarter. The mean and median assets of merged credit unions are $124 million and $21 million, respectively.

Credit union mergers this year are trending very close to 2024, which had a total of 162 mergers. With 80 mergers so far in the first half of 2025, we are about halfway to last year’s total. And with $8 billion in merged assets, we are already more than halfway to last year’s total of about $15 billion in acquired assets.

Large Credit Union Acquirers

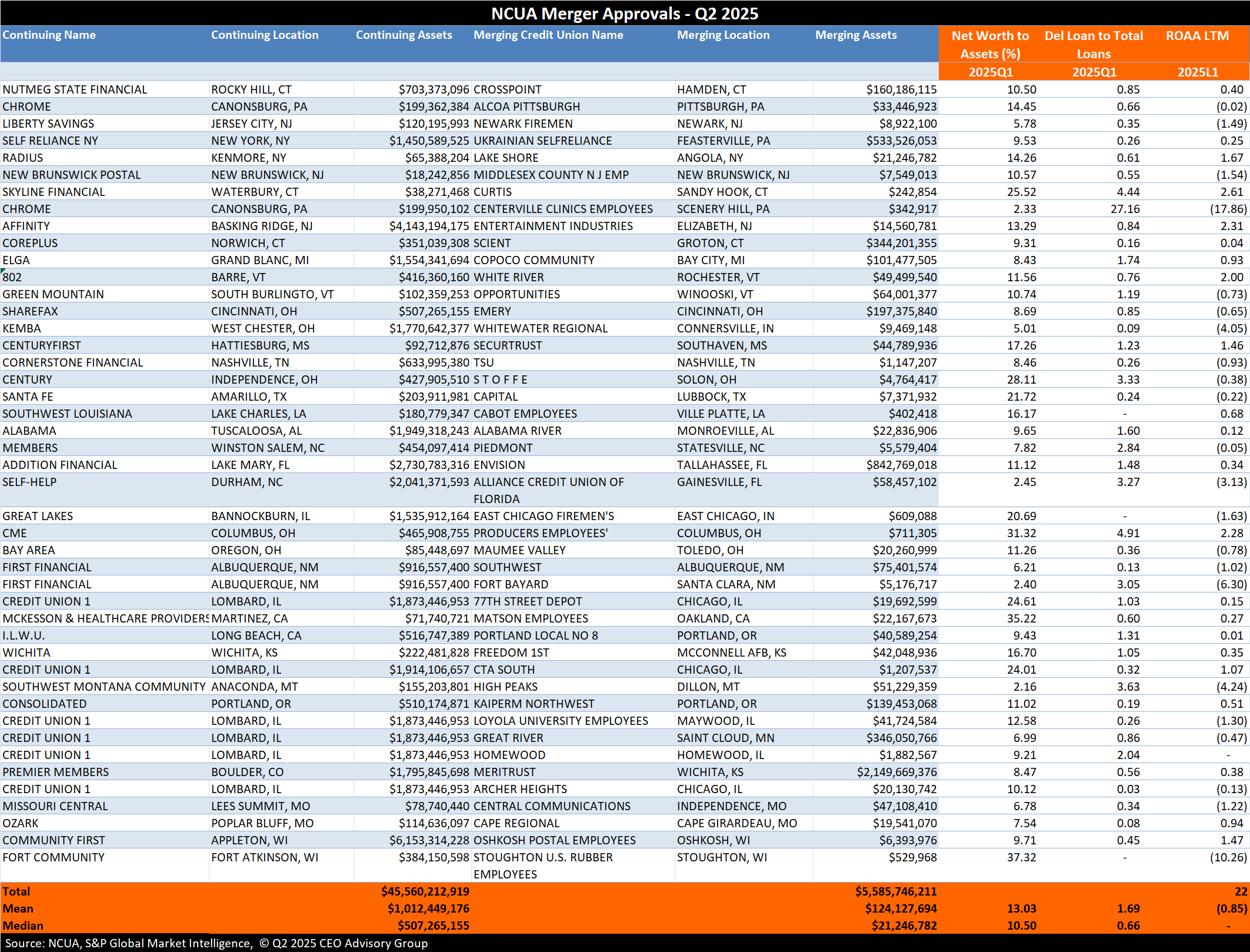

There were three acquisitions of credit unions with assets exceeding $500 million this quarter. $533 million Ukrainian Selfreliance Credit Union, Feasterville, Pennsylvania, merged with $1.4 billion Self Reliance Credit Union, New York. In Tallahassee, Florida, $843 million Envision Credit Union merged with $2.7 billion Addition Financial in Lake Mary. Also $2.1 billion Meritrust Credit Union, Wichita, Kansas and $1.8 billion Premier Members Credit Union, Boulder, Colorado are merging. Premier Members Credit Union will operate as a division of Meritrust Credit Union.

The median asset size of the continuing credit unions is $507 million. Sixteen of the acquiring credit unions have assets exceeding $1 billion. On the other side of the spectrum, there are seven credit union acquirers with assets below $100 million for Q2. Combined, the acquiring credit unions had $45.5 billion in assets, with an average asset size of $1 billion.

The acquired credit unions have a median of $21 million in assets and a mean of $124 million. There are six credit unions with less than $1 million in assets being acquired. The smallest credit union merger partner is Curtis Credit Union, in Sandy Hook, Connecticut, with assets of $242,854.

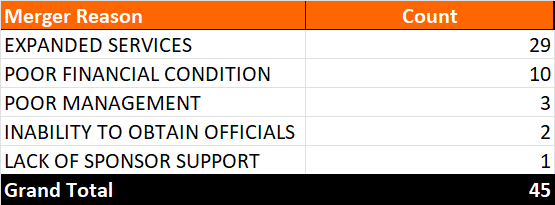

Reasons for Credit Union Mergers

When seeking regulatory approval, credit unions are required to cite the reason for the merger. As shown in the chart below, 29 of the Q2 transactions listed expanded services as the reason for the merger. However, almost 30% cited poor financial condition or poor management.

The financial performance of the acquired credit unions could be characterized as mixed. The median net worth ratio of the merging credit unions is 10.50%, indicating good capitalization. However, there are nine unions that have net worth ratios below 7.0%, which is considered undercapitalized.

Other financial performance indicators present a similarly mixed view. The delinquent loans-to-total loans ratio averages 1.69%. The mean return-on-assets (ROA) was negative 0.85% in the last 12 months, and the median was negative 0.01%. More concerning was almost half of the merging credit unions (22 out of 45) reported negative earnings in the last 12 months.

Below is a chart of the NCUA merger approvals for Q2 2025:

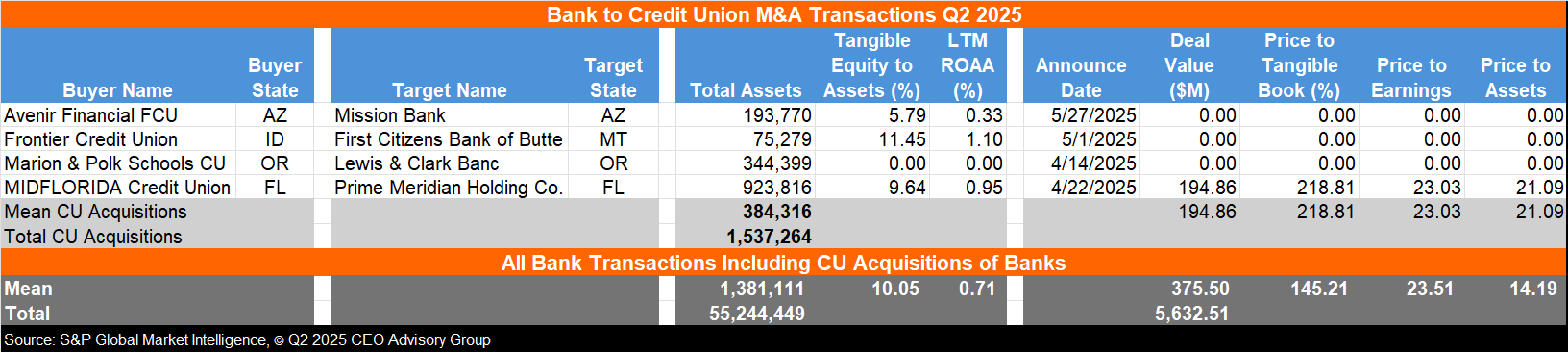

Credit Union Acquisitions of Banks

Bank consolidation proceeded at a slightly slower pace than credit union mergers, with a total of 34 bank acquisitions announced in the second quarter of 2025, worth $5.5 billion in assets. During this time, credit unions acquired four banks. In total, the banks being acquired had assets of $1.5 billion, up from just under $1 billion acquired in bank to credit union mergers in the first quarter.

The deal terms were announced in just one credit union bank acquisitions of banks, with MidFlorida Credit Union, Lakeland, acquiring Prime Meridian Holding Company, Tallahassee, for a price to tangible book of 218%. The acquisition brings MidFloriday’s assets to $9.5 billion. Among all bank acquisitions reporting deal terms, the average price/tangible book was 145.21%.

For all acquired banks, the average ROAA was 0.71%.

Following is a deal summary of the credit union acquisitions of banks and a summary of all bank transactions:

CEO Advisory Group

CEO Advisory Group