Merger Approvals Peak Again in October

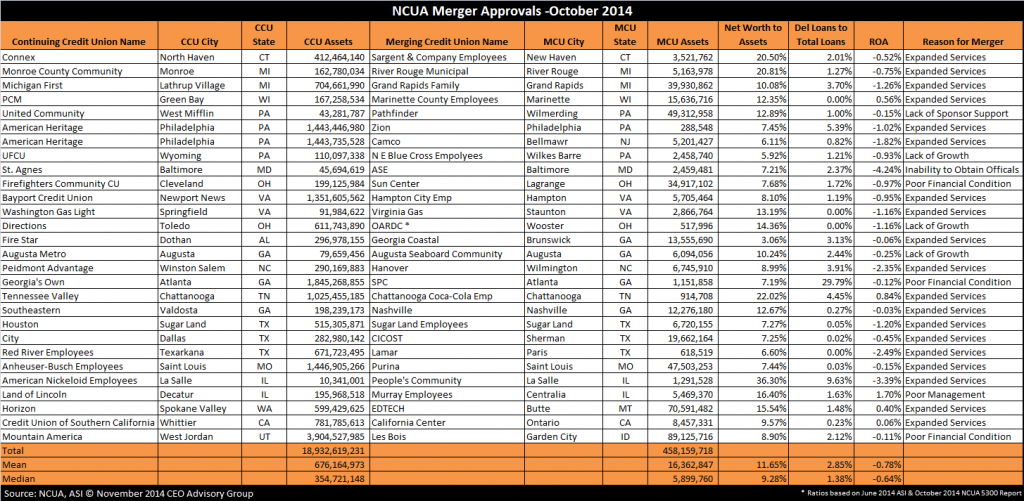

The NCUA approved 28 mergers in October 2014 which is the second highest merger approval rate for the year.

The combined assets of the merged credit unions are $458 million. The mean and median assets of merged credit unions are $16.4 million and $5.9 million respectively.

There we two mergers with credit unions exceeding $50 million in assets.

Horizon CU ($600 million) based in Spokane Valley Washington received NCUA approval to merge with Butte, MT based EDTECH FCU. “Expanded service” is the motivating factor for EDTECH merger. This financially strong credit union has $71 million in assets, 15.5% net worth to capital ratio, and a history of consistently good earnings.

Garden City, ID based Les Bois CU with $89 million in assets received approval to merge into $4-billion asset Mountain America CU headquartered in West Jordan, UT. “Poor financial condition” is cited as the reason for the merger. Through September Les Bois reported net worth ratio of 8.9%, delinquency ratio of 2.1% and ROA of -0.1%

The median size of acquiring credit unions is $355 million. There were 7 credit union acquirers with assets exceeding $1 billion. Mountain America CU was the largest acquiring credit union in October. Georgia’s Own CU, which is merging Atlanta-based SPC CU with $1.2 million in assets, was the second largest acquirer with $1.8 billion in assets.

Interestingly, there was one merger of equals where the merged credit union is smaller than the continuing credit union. Wilmerding, PA based Pathfinder CU, with $49 million in assets indicates “lack of sponsor support” as the reason for its merger with $43 million asset United Community headquartered in West Mifflin, PA.

Four credit unions with less than $1 million in assets are being acquired, including Non-NCUA-Insured OARDC Credit Union, which is being merged by Directions CU.

The median net worth ratio of the merging credit unions is 11.7%. Four credit unions have net worth ratios below 7.0%.

The delinquent loans-to-total loans ratio averages 2.85%, which is primarily attributed to two credit unions with delinquency ratios exceeding 9% of loans.

Only five of the 28 credit unions have positive earnings year to date. Consequently the mean return-on-assets (ROA) is -0.78% year through September of this year.

“Expanded services” continues to be the primary factor motivating these mergers. “Lack of sponsor support” and “inability to obtain officials” also contributed to the mergers this month.

Below is a chart of the NCUA merger approvals for October 2014:

CEO Advisory Group

CEO Advisory Group