Credit Union Mergers Analysis: First Quarter 2025

An analysis of credit union mergers for the first quarter of 2025 shows quarterly fluctuation in the number of approved transactions, with a slight decrease in merger approvals and the combined asset size of merging institutions. Looking at year-over-year comparisons, the number of mergers continues to trend upward from 2024 levels, but assets acquired are down.

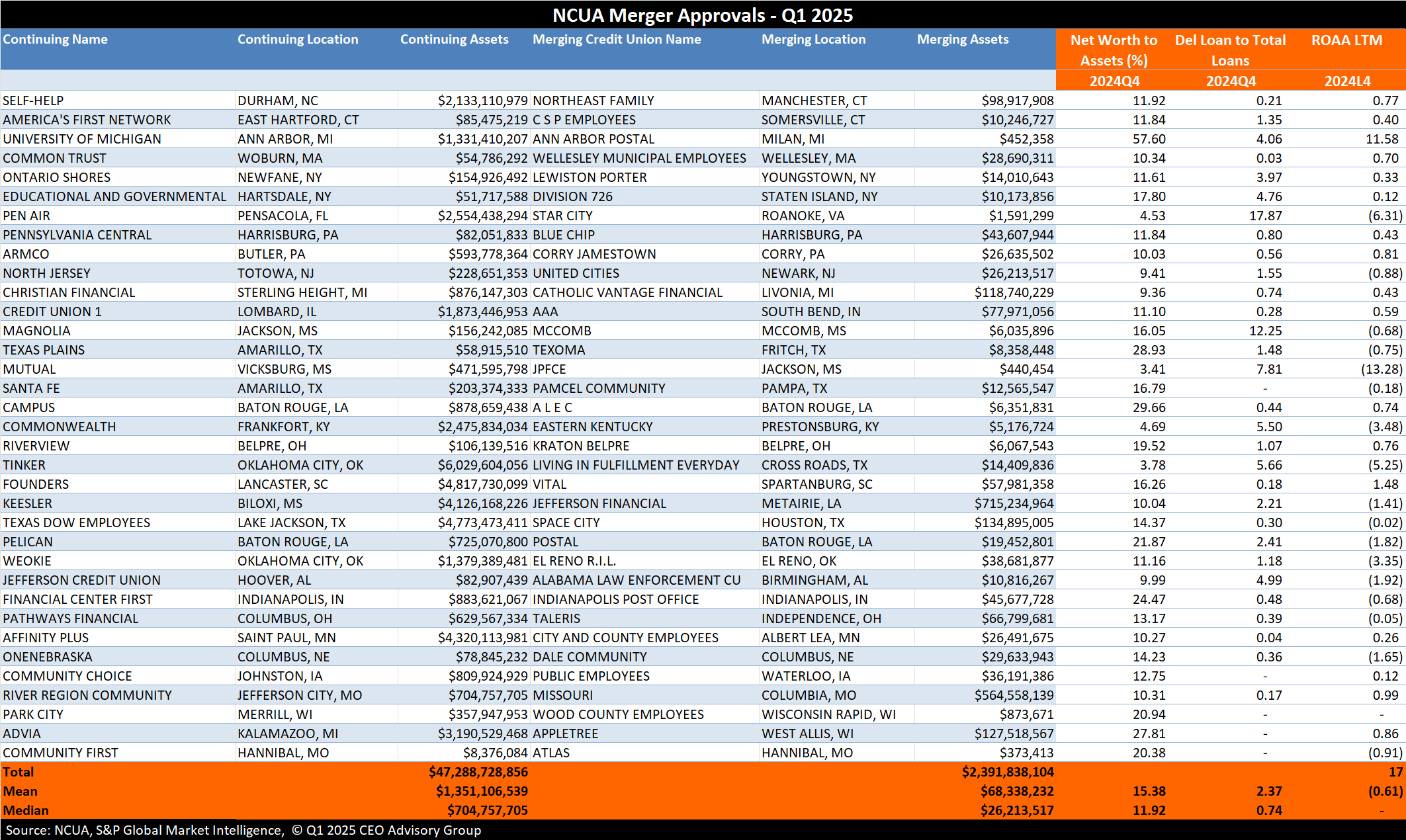

The NCUA approved 35 mergers in Q1 2025, a 14.6% decrease from the 41 mergers that occurred in the previous quarter, but an increase from the 26 mergers in Q1 of 2024. The combined assets of merged credit unions totaled $2.4 billion, which represents a decrease compared to $2.7 billion in Q4 2024 and $3.7 billion a year ago. The mean and median assets of merged credit unions are $68 million and $26 million, respectively, showing an increase in both average and median merger size from the previous quarter, which had a mean of $66 million and median of $13 million.

Large Credit Union Acquirers

There were two notable acquisitions of credit unions with assets exceeding $500 million this quarter. Jefferson Financial Credit Union, with $715 million in assets, based in Metairie, Louisiana, merged into Keesler Credit Union, which has $4.1 billion in assets and is based in Biloxi, Mississippi. Missouri Credit Union, based in Columbia with $564.5 million in assets, merged into River Region Community Credit Union, which has $704.7 million in assets and is based in Jefferson City.

The continuing credit unions are predominantly large, with average assets of $1.3 billion and a median of $704 million in assets. Twelve of the acquiring credit unions have over $1 billion in assets. On the other side of the spectrum are several smaller credit union acquirers with assets below $100 million for Q1. The acquired credit unions represent approximately 3.7% of the assets of the acquiring credit unions on average.

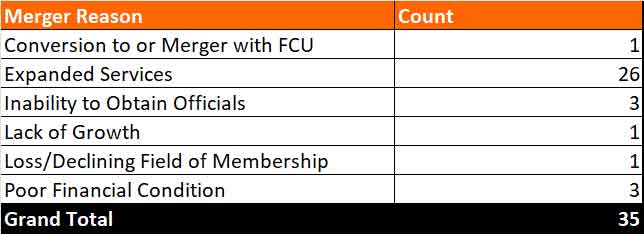

Reasons for Credit Union Mergers

When seeking regulatory approval, credit unions must cite the reason for the merger. As in previous quarters, expanded services continues to be the most frequently cited reason for mergers. Almost 75% of the Q1 transactions listed expanded services as the primary motivation for the merger. However, approximately 8% cited poor financial condition as the driving factor.

The financial performance of the acquired credit unions shows a challenging picture in Q1 2025. While median net worth ratios (11.92%) indicate adequate capitalization for most merging institutions, 17 of the 35 merging credit unions (49%) reported negative return-on-assets (ROA) in the last 12 months. This high percentage of institutions with negative ROAAs may indicate ongoing profitability challenges in some segments of the credit union industry.

Below is a chart of the NCUA merger approvals for Q1 2025:

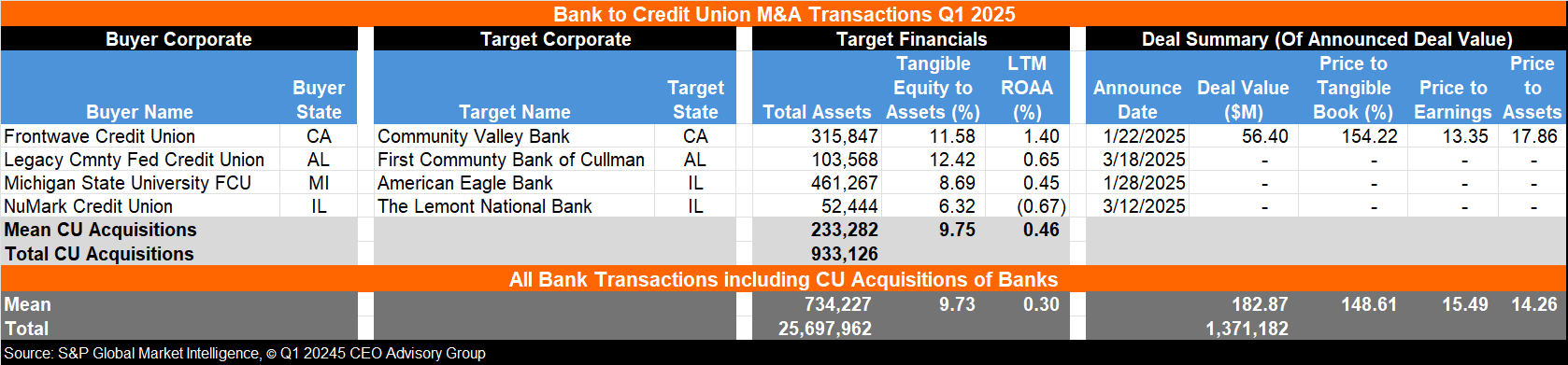

Credit Union Acquisitions of Banks

Bank consolidation continued at a comparable pace to credit union mergers, with 35 total whole bank acquisitions in the first quarter of 2025. Credit unions were the acquirers in four bank acquisitions, representing approximately 11% of all announced bank acquisitions. These acquired banks had assets of $933 million, down from $3 billion last quarter. In total, banks acquired in Q1 had $25.7 billion in assets, with a mean of $734 million.

For all acquired banks, the average ROAA was 0.30%, with nine (including one acquired by a CU) reporting a negative ROAA in the last 12 months before the announced M&A transaction.

Only one credit union announced the deal terms. In January 2025, Frontwave Credit Union announced the acquisition of Community Valley Bank, with $316 million in assets. Both institutions are in Southern California. The transaction was reported with a price/tangible book of 154% and a price/earnings multiple of 13.3, according to S&P Global Market Intelligence. Among all bank acquisitions reporting deal terms, the average price/tangible book was 148.6%.

Following is a deal summary of the credit union acquisitions of banks and a summary of all bank transactions:

CEO Advisory Group

CEO Advisory Group