Credit Union Merger Approvals – January 2018

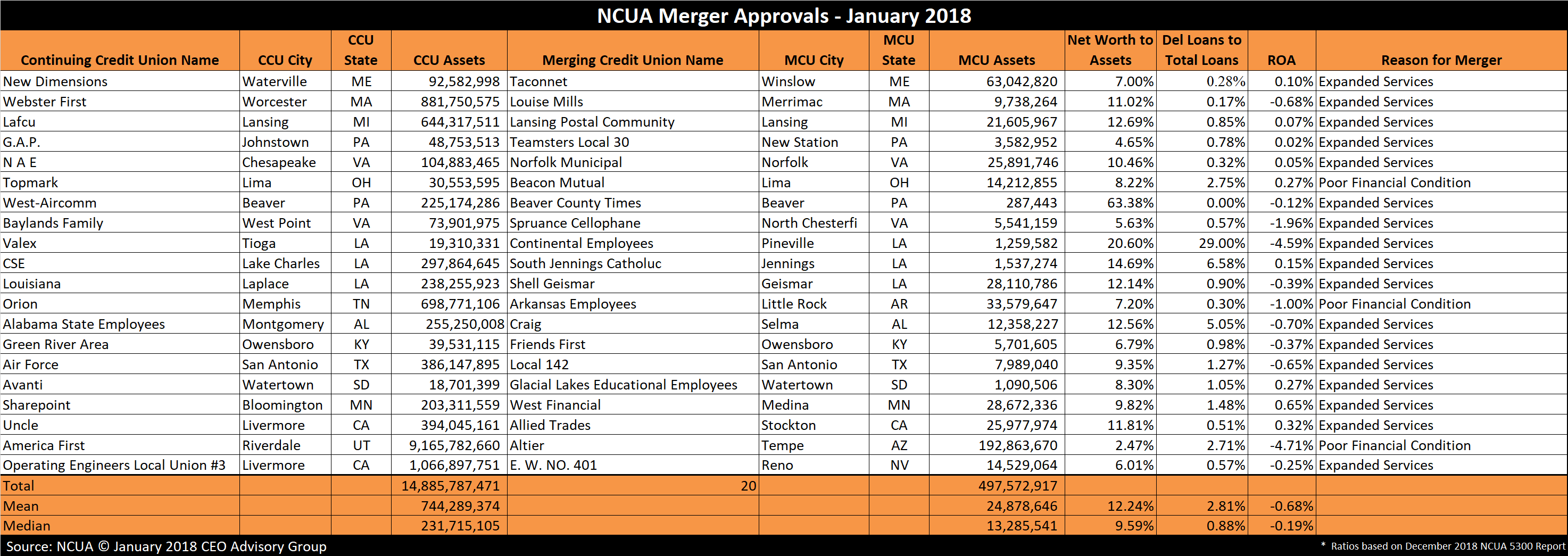

NCUA approved 20 mergers in January 2018 which increased from 8 last month. The combined assets of merged credit unions are up nearly $342M compared to last month. However, for the month of January, the total merged assets are down, $498 million compared to last year’s $1.134 billion. That’s a difference of $636 million. The mean and median assets of merged credit unions are $24.9 million and $13.3 million respectively.

Large Credit Union Mergers

There was one acquisition of a credit union with assets exceeding $100 million this month.

The largest merger was Tempe, AZ based Altier Credit Union ($193M) merging into America First Credit Union ($9.2B) headquartered in Riverdale, UT. Altier Credit Union is significantly undercapitalized (2.47% Net Worth), has high delinquency 2.71%) and is profitability issues (-4.71% ROA). “Poor Financial Condition” was given as the reason for the merger.

Click Here to Download White Paper “From Discovery to Integration”

Credit Union Merger Stats

The median size of acquiring credit unions is $232 million. There are two credit union acquirers with assets exceeding $1 billion.

With $9.2 billion in assets, America First Credit Union was the largest acquiring credit union in January.

The other credit union with assets exceeding $1 billion included:

- Operating Engineers Local Union #3 Credit Union, Livermore, CA ($1.1B)

The acquired credit unions on average represent 3% the of the assets of the acquiring credit unions.

The nearest merger of equals is Winslow, ME based Taconnet Employees Credit Union ($63M) merging into New Dimensions Credit Union ($93M) headquartered in Waterville, ME.

There is one credit union with less than $1 million in assets being acquired. The smallest credit union is Beaver County Times Credit Union based Beaver, PA with $287,443 in assets, which is being acquired by $225 million in assets West-Aircomm Credit Union headquartered in Beaver, PA.

Reasons for Credit Union Mergers

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 20 mergers in January, the following reasons were given:

- Expanded Services: 17

- Poor Financial Condition:3

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 9.59%. There are 5 credit unions that have a net worth ratio below 7.0%, which is considered under-capitalized.

The delinquent loans-to-total loans ratio averages 2.81%

Nine of the 20 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -0.68% and median -0.19% for January of 2018.

Below is a chart of the NCUA merger approvals for January 2018:

CEO Advisory Group

CEO Advisory Group