Top 20 Credit Union Mergers 2014

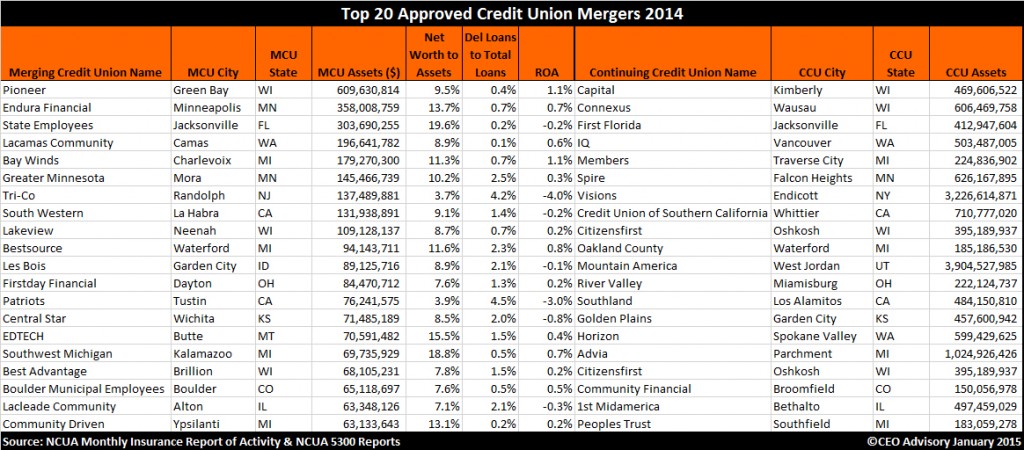

The 20 largest mergers approved by the NCUA in 2014 accounted for nearly $3 billion in assets. This represented nearly 20% of the assets of the credit unions they merged into (continuing credit unions). Mergers of equals are relatively rare, yet four (20%) of the top 20 have relatively equal asset sizes.

Pioneer CU ($610M) merger into the smaller Capital CU ($470M) was the largest merger of the 2014.

Closely following in asset size was Connexus CU ($606M) merger of Endura Financial CU ($358). Also exceeding the $300 million threshold was First Florida CU’s acquisition of Jacksonville-based State Employees CU ($304M).

Peoples Trust CU’s ($183M) merger of Community Driven CU ($63M) was the smallest merger in the top 20.

Larger credit union mergers are generally strategic in nature and not driven by poor financial performance. Among the top 20 there are only two credit unions with capital below 7%. These same credit unions also had a high negative ROA.

Out-of-state mergers are becoming increasingly popular. Four mergers in the top 20 were across state lines, including Horizon CU’s merger of Butte CU that crossed two state lines.

CEO Advisory Group

CEO Advisory Group