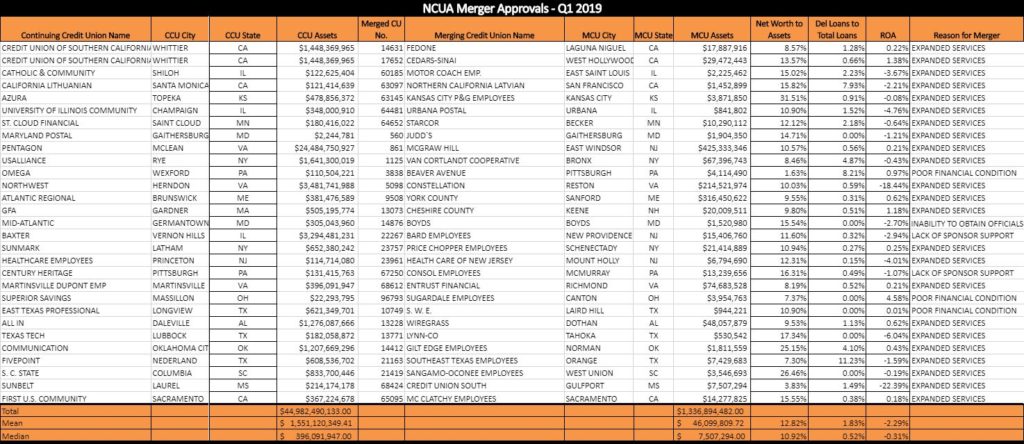

Merger Approvals Q1 2019

NCUA approved 28 mergers in Q1 of 2019 which decreased from 53 last quarter. The combined assets of merged credit unions is $1.3B, which compares to $1.5B last quarter and $800M year ago.

The mean and median assets of merged credit unions are $46M and $7.5M, respectively.

LARGE CREDIT UNION MERGERS

There were three acquisitions of a credit unions with assets exceeding $100 million this quarter.

The largest was McGraw Hill located in East Windsor, NJ acquired by Pentagon headquartered in McLean, VA. McGraw Hill has strong cap (10.57% Net Worth), low delinquency (0.56%), and profitable (0.21%).

Click Here to Download White Paper “Align Member & Executive Interests”

CREDIT UNION MERGER STATS

The median size of acquiring credit unions is $396 million. There are 3 credit union acquirers with assets exceeding $2 billion.

With $24 billion in assets, Pentagon was the largest acquiring credit union in Q1.

The other continuing credit unions with assets exceeding $1 billion were:

- Northwest ($3.4B)

- Baxter ($3.2B)

- USAlliance ($1.6B)

- Credit Union of Southern Cal ($1.4B)

- All In ($1.2B)

- Communication($1.2B)

The acquired credit unions on average represent 2% the of the assets of the acquiring credit unions.

The nearest merger of equals is:

Gaithersburg, MD based Judd’s ($1.9M) merging into

Maryland Postal ($2.2M) headquarted in Gaithersburg, MD.

There are three credit unions with less than $1 million in assets being acquired. The smallest credit union is Lynn-Co based Tahoka, TX with $0.5M in assets, which is being acquired by $182M in assets Texas Tech in Lubbock, TX.

REASONS FOR CREDIT UNION MERGERS

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 28 mergers in Q1, the following reasons were given:

- Expanded Services: 22

- Poor Financial Condition: 3

- Inability to Obtain Officials: 1

- Lack of Sponsor Support: 2

FINANCIAL PERFORMANCE OF ACQUIRED CREDIT UNIONS

The median net worth ratio of the merging credit unions is 10.9%. There are two credit unions that have a net worth ratio below 7.0%, which is considered undercapitalized. Worst was Beaver Avenue credit union which had a 1.63% net worth ratio.

The delinquent loans-to-total loans ratio averages 1.83%

Sixteen (16) of the 28 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) was -2.29% and median -0.02% for Q1 of 2019. Below is a chart of the NCUA merger approvals for Q1 2019:

CEO Advisory Group

CEO Advisory Group