January 2015 Merger Approvals

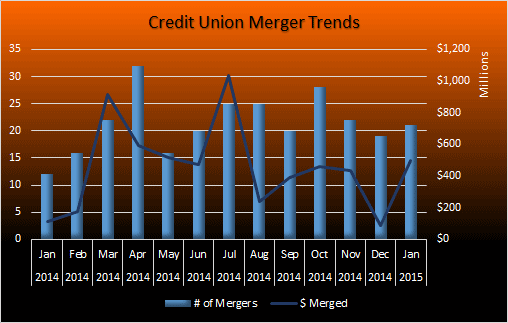

The NCUA approved 21 mergers in January 2015 which is up from the 12 mergers in January of last year.

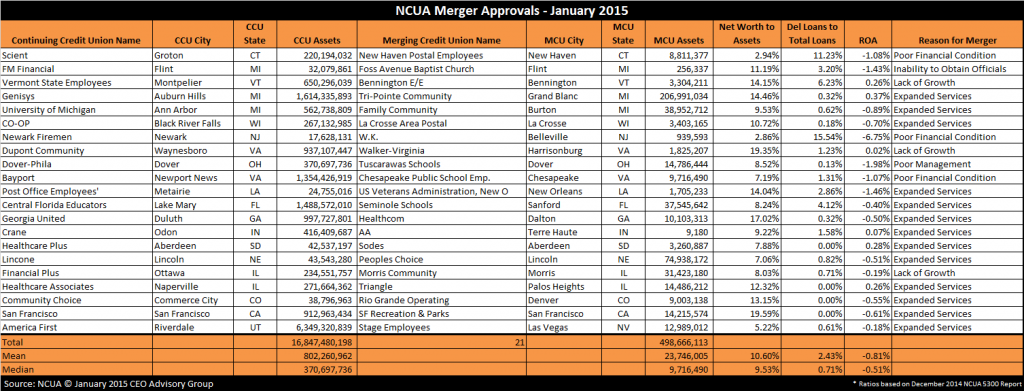

While credit union mergers continue to be primarily smaller credit unions, the January numbers were an aberration from the most recent quarter with slightly larger credit union mergers. The combined assets of the merged credit unions were nearly $500 million. The mean and median assets of merged credit unions are $23.7 million and $9.7 million respectively. In contrast, in December the mean assets were $5.5 million.

Large Credit Union Mergers

There were two mergers with credit unions exceeding $50 million in assets.

The largest merger was $207 million, Grand Blanc, MI based Tri-Pointe Community Credit Union which was approved to merge into Genisys Credit Union ($1.6 billion) based out of Auburn HIlls. “Expanded Services is cited as the reason for the merger. Through December Tri-Pointe reported a net worth ratio of 14.46%, delinquency ratio of 0.32% and ROA of 0.37%.

Peoples Choice Credit Union ($75 million) located in Lincoln, NE merged into the smaller Lincone Credit Union ($44 million) also headquartered in Lincoln. Peoples Choice had a net worth ratio of 7.1%, delinquent loan ratio of 0.82% and a ROA of -0.51%.

Credit Union Merger Stats

The median size of acquiring credit unions is $370 million. There were four credit union acquirers with assets exceeding $1 billion. With $6.3 billion in assets America First CU, based in Riverdale, UT, was the largest acquiring credit union in January merging Stage Employees CU ($13 million). Acquiring credit unions Genisys CU, Bayport CU, and Central Florida Educators CU also had assets exceeding $1 billion.

The acquired credit unions on average represented only 3% of the assets of the acquiring credit unions. Aside from the Lincone’s acquisition of the larger People’s Choice CU there was a significant size differential between the merging credit unions. Nearest in relative size was Rio Grande Operating CU with 9 million in assets which represented 23% of the assets of Community Choice CU.

Three credit unions with less than $1 million in assets are being acquired. The smallest credit union is AA CU based in Terre Haute, IN with $9,000 in assets. AA CU is being acquired by $416 million Crane CU.

Reason for Credit Union Mergers

“Expanded services” continues to be the primary factor motivating these mergers with 62% selecting this as the reason for the merger. “Poor financial condition” was the reason for the merger sited by three of the credit unions. “Lack of growth” was given as the merger reason by 3 of the credit unions. “Inability to obtain officials” was also cited as a reason for the merger.

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 9.5%. Three credit unions have net worth ratios below 7.0%.

The delinquent loans-to-total loans ratio averages 2.4%, which is primarily attributed to two credit unions with delinquency ratios exceeding 10% of loans. This includes the 16% delinquency ratio reported by W.K. Credit Union.

Only six of the 21 credit unions have positive earnings year to date through December 2014. Consequently the mean return-on-assets (ROA) is -0.8% through December of this year.

Below is a chart of the NCUA merger approvals for January 2015:

CEO Advisory Group

CEO Advisory Group