Important Factors in Assessing a CU Merger

Credit union mergers have become increasingly more common. From the 23,000 credit unions that existed at their peak in 1969 to the 5,200 credit unions that existed as of 2020, the industry has seen a lot of shift. That’s because credit union leaders have begun to realize that merger benefits not only help their bottom lines, but they also enhance the lives of their members and employees, too.

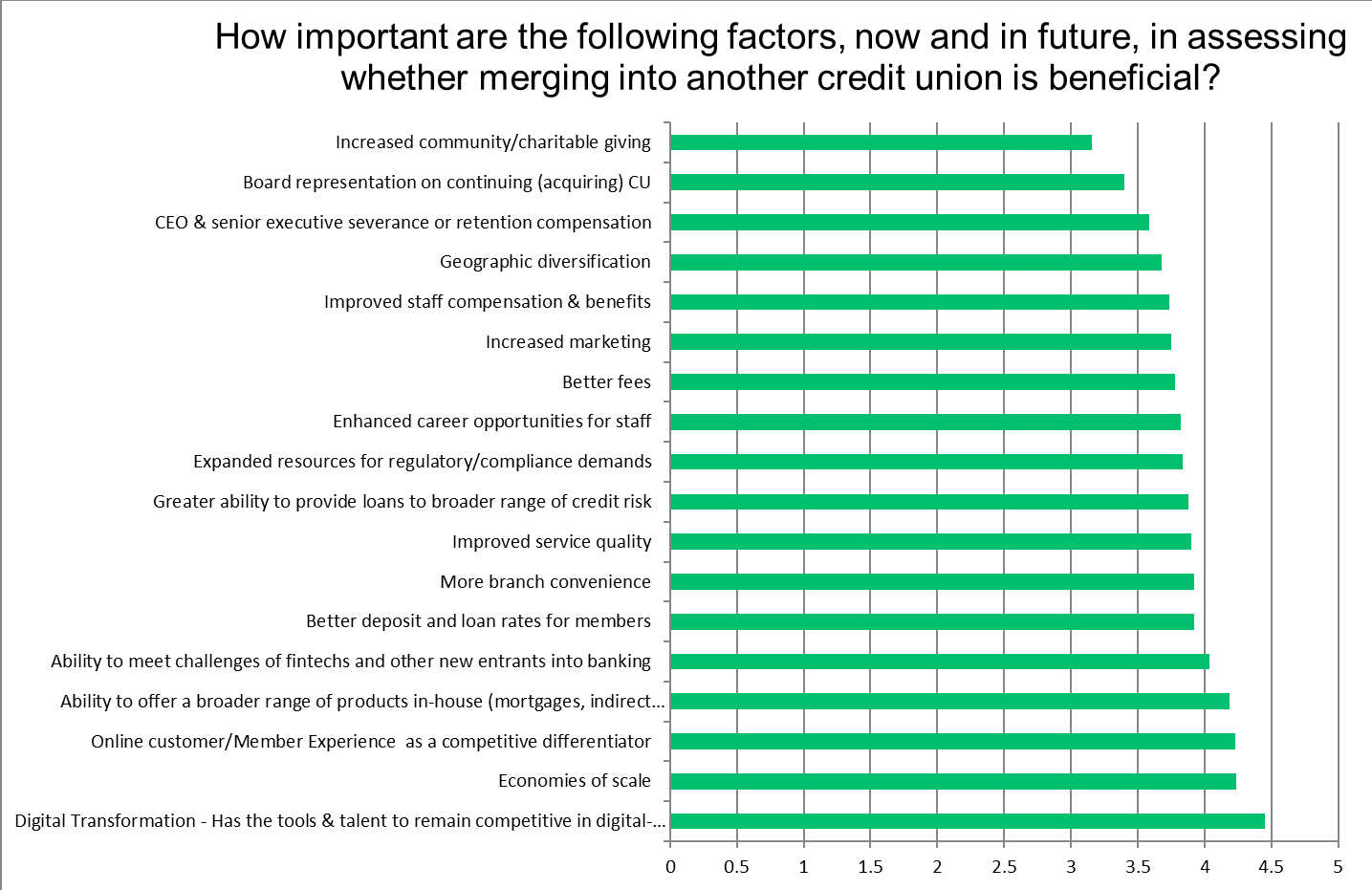

Of course, mergers come with big decisions, none of which should be weighed lightly. The following are important factors to consider when assessing merger benefits or detriments, based on a study commissioned by CEO Advisory Group during Q4 of 2019:

1. Digital Transformation

The overwhelming leader in the survey was digital transformation. That is to say, over 60% of survey respondents consider it necessary to have tools and talent in place to remain competitive in this ever-changing digital landscape.

Members’ expectations have changed in recent years, only becoming more reliant on real-time technology, mobile access, and other digital tools. One of the greatest merger benefits smaller credit unions can realize is access to technologies they might not otherwise have been able to tap into.

2. Economies of Scale

With constantly changing rules and regulations pertaining to the credit union industry, it’s no surprise that half of survey respondents indicated that economies of scale were among the merger benefits they’d consider if the right acquiring company presented itself.

With economies of scale, larger credit unions are able to allocate their resources in ways that make the most of employees’ time without leaving anyone feeling stretched or overburdened, while simultaneously ensuring the health and well-being of the organization.

When economies of scale come into play, credit unions can make the most of their resources in a strategic and cost-effective way.

3. Online Member Experience as a Competitive Differentiator

50% of survey respondents also indicated that online member experiences were at the forefront of their concerns when they’re considering merger benefits. In a way, this relates to digital transformation and technologies, but this category is focused more on the member experience, rather than simply the products a credit union can offer its membership base.

As of 2018, 83% of credit union members accessed their accounts and other information only at least once a month using a laptop, tablet, or another computer device, while 50% of members accessed their accounts with mobile devices. Naturally, these numbers have likely only grown, as humans’ dependency on technology becomes even more interwoven.

Among merger benefits smaller CUs can experience when they partner with larger organizations is the ability to differentiate themselves against their competitors by way of online experiences that meet their members’ needs wherever and whenever they need access to their accounts.

Interesting Statistics

In a surprising turn, 11% of leaders indicated increasing community and charitable giving was not important at this time. Board representation on continuing (acquiring) CUs tied with geographic diversification as less important than other elements credit union leaders are considering.

Besides the top three categories, which were previously mentioned, the following additional considerations made the top ten list:

- Ability to offer a broader range of in-house products (including mortgages, indirect loans, business services, and investments)

- Ability to meet the challenges of fintechs and other new entrants into the banking industry

- Better deposit and loan rates for members

- More branch convenience

- Improved service quality

- Greater ability to provide loans to a broader range of applicants

- Ability to expand resources to meet regulatory and compliance demands

To gain more real-world insight into merger benefits and the factors leaders are weighing as they consider merger possibilities, download our free white paper.

CEO Advisory Group

CEO Advisory Group