Credit Union Merger Approvals September 2015

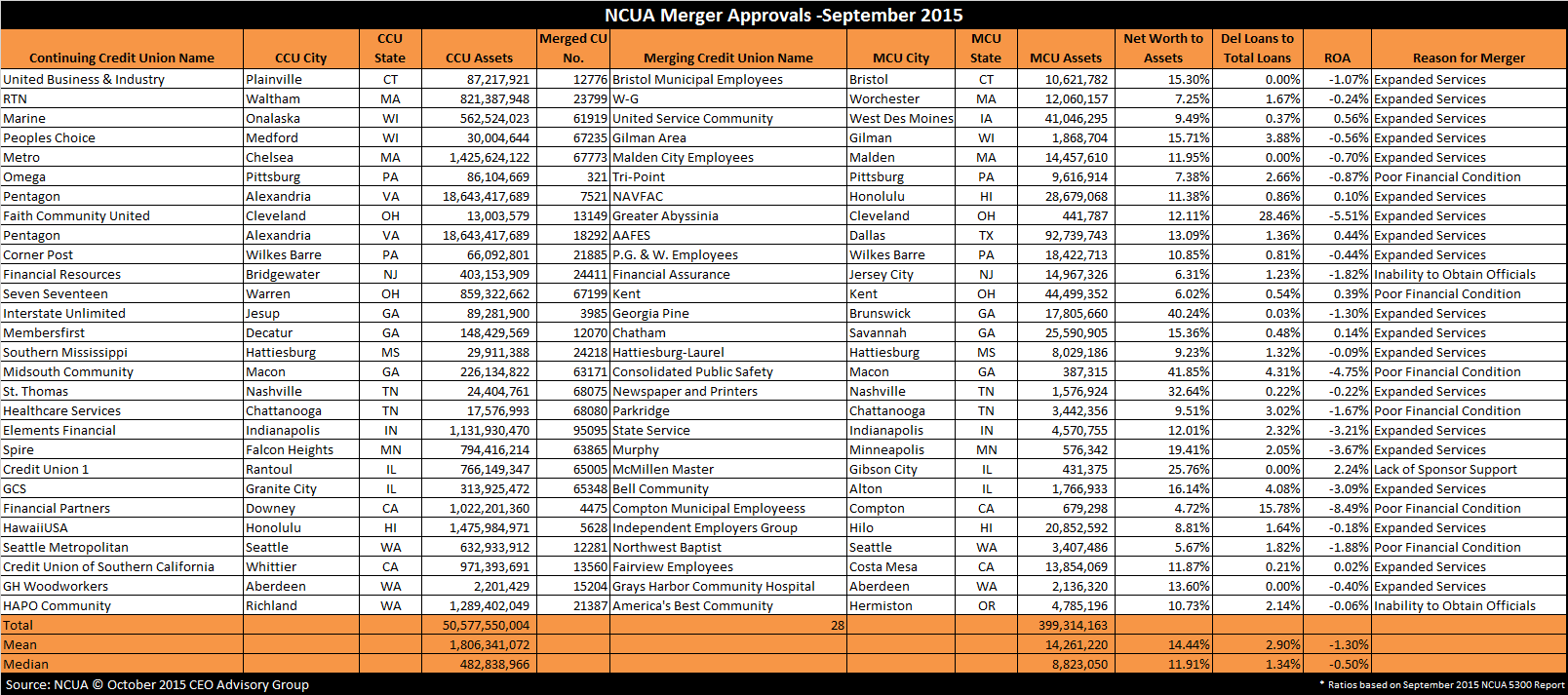

The number of mergers is up compared to last month and year. The NCUA approved 28 mergers in September 2015, which is up from the 16 mergers last month and 20 in September of last year.

The combined assets of merged credit unions is up compared to last month. Total assets of the merged credit unions is $399 million compared to last month’s $223 million. The mean and median assets of merged credit unions are $14.2 million and $8.8 million respectively. In contrast, last month the mean assets were $13.9 million.

Large Credit Union Mergers

There were no acquisitions of credit unions with assets exceeding $100 million this month.

The largest merger was Dallas-based AAFES Credit Union ($93M) merging into Pentagon FCU ($19B) headquartered in Alexandria, VA. AAFES CU is well capitalized (13.1%) and positive earnings (0.4% ROA). AAFES Federal Credit Union CEO Cheryl Gibson expressed excitement about joining PenFed. “Becoming part of the PenFed family will have an overwhelmingly positive impact that our members will notice right away,” she said. “As a part of the PenFed team, we’re able to offer members the value of low-cost auto loans and mortgages, great credit products and the convenience of mobile transactions. Our members are going to experience a new level of credit union service and value through this partnership.”

Credit Union Merger Stats

The median size of acquiring credit unions is $483 million. There are six credit union acquirers with assets exceeding $1 billion.

With $19 billion in assets Pentagon FCU was the largest acquiring credit union in September merging $93 million AAFES CU and $29 million NAVFAC CU, which is based in Honolulu, HI.

HawaiiUSA FCU, located in Honolulu, Hawaii, with $1.5 billion in assets acquired Hilo, HI based Independent Employers Group CU, which has $21 million in assets.

The acquired credit unions on average represented 1% of the assets of the acquiring credit unions.

There was one merger of equals among two tiny credit unions located in Aberdeen, WA. GH Woodworkers CU ($2.2M) acquired Grays Harbor Community CU (2.1M).

There are five credit unions with less than $1 million in assets being acquired. The smallest credit union is Consolidated Public Safety Credit Union based in Macon, GA with $387,000 in assets, which is being acquired by $341 million Midsouth Community Credit Union also from Macon.

Reasons for Credit Union Mergers

When seeking regulatory approval credit unions are required to site the reason for the merger. Of the 28 mergers in September, the following reasons were given:

- Expanded services: 19

- Lack of sponsor support: 1

- Inability to obtain officials: 2

- Poor financial condition: 6

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 11.9%. Four credit unions had a net worth ratio below 7.0% and are considered under-capitalized.

The delinquent loans-to-total loans ratio averages 2.9%, which is primarily attributed to two credit unions with delinquency ratios exceeding 5% of loans, including 28% delinquency at $441,00 asset Greater Abyssinia Credit Union, which is located in Cleveland, OH.

Only seven of the 28 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -1.3% and median -0.5% through September of this year.

Below is a chart of the NCUA merger approvals for September 2015:

CEO Advisory Group

CEO Advisory Group