August Merger Approvals Mostly Tiny Credit Unions

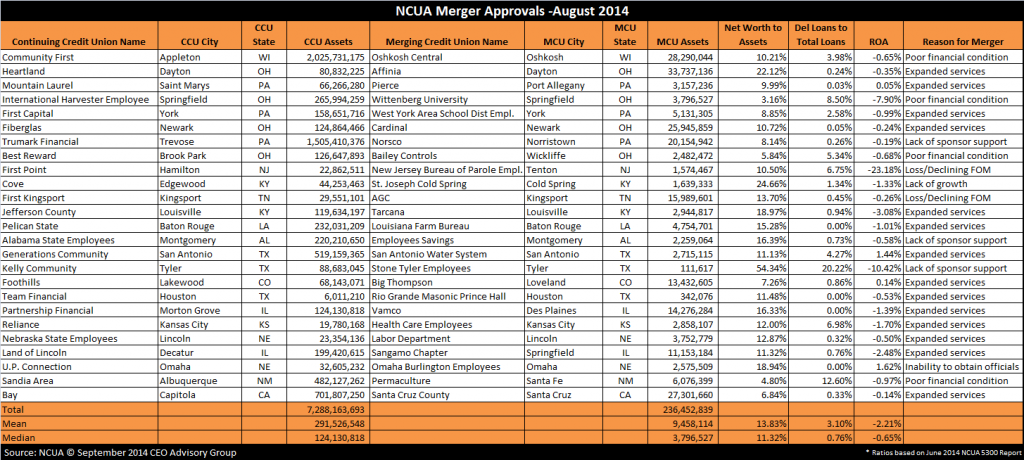

Just as last month the NCUA approved twenty-five (25) mergers in August 2014.

However, the asset-size of mergers in August was much smaller. Combined the total assets of the credit unions was $236 million, which is less than a quarter of the assets merged in July. The mean and median assets were $9.5 million and $3.8 million, respectively.

The largest merger was Dayton, OH based Affinia CU ($38 M) merging into Heartland CU ($81 M). Affinia has an exceptionally large Net Worth to Asset ratio of 22%. Delinquency was also a modest 0.24% of Loans. ROA has however been negative the last 3 ½ years. The credit union has also been struggling with growth as membership and loans have been declining rapidly the last 4 years.

The median net worth ratio of the merged credit unions was 11.3% with the mean slightly higher at 13.8%.

All but 4 of the merging credit unions reported losses YTD for June 2014. The median and mean ROA was -0.65% and -2.21%, respectively.

The merged credit unions had a median delinquency ratio of 0.76%. The mean delinquency of 3.1% was skewed by a couple small credit union with double-digit delinquency ratios, including 20% loan delinquency reported by the tiny $112,000 Stone Tyler Employees CU based in Texas.

Over half (56%) of the merging credit unions reported Expanded Services as the reason for the merger. Poor financial condition was the primary factor in four of the mergers. Lack of sponsor support was a motivating factor in three of the mergers.

Below is a chart of the NCUA Merger Approvals:

CEO Advisory Group

CEO Advisory Group