August Delivers 16 Credit Union Mergers

The number of mergers is down compared to last month and year. The NCUA approved 16 mergers in August 2015, which is down from the 20 mergers in July and 25 in August of last year.

While the number of mergers this month was smaller the combined assets was were about equal. Total assets of the merged credit unions is nearly $223 million compared half of last year’s $235 million. The mean and median assets of merged credit unions are $13.9 million and $7.6 million respectively. In contrast, last month the mean assets were $9.5 million.

Large Credit Union Mergers

There was one merger with a credit union exceeding $100 million in assets.

Spokane, WA based United Health Services Credit Union ($102M) is merging into Horizon Credit Union ($716M) headquartered in Spokane Valley, WA. United Health Services CU is strong financially with 10.3% net worth/capital ratio, very low delinquency and strong earnings (1.2% ROA). United Health Services CU CEO Chuck Zeller says “over the years we’ve talked about the need to offer more to members as far as technology. We haven’t had the resources to do that in the past. The merger will provide United Health Services Credit Union members access to technology and service they’ve been asking for, including opening and managing accounts online, remote deposit and capture, 24-hour lending and mobile apps.“

Credit Union Merger Stats

The median size of acquiring credit unions is $252 million. This month there is only one credit union acquirer with assets exceeding $1 billion. With $1.1 billion in assets Greylock Credit Union, based in Pittsfield, MA was the largest acquiring credit union in August merging $12 million Berkshire Credit Union.

The acquired credit unions on average represented 4% of the assets of the acquiring credit unions.

There were no merger of equals in the month of August.

One credit union with less than $1 million in assets is being acquired. The smallest credit union is D-B Employees CU based in Johnston City, IL with $219,000 in assets, which is being acquired by $300 million SIU Credit Union.

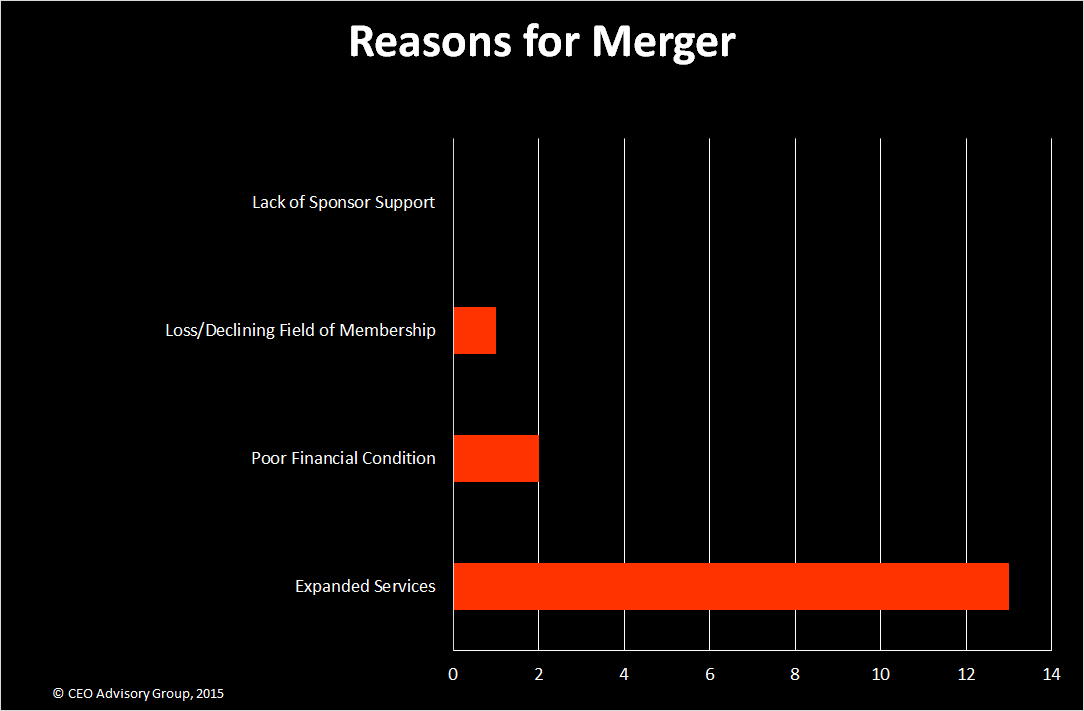

Reasons for Credit Union Mergers

“Expanded services” continues to be the primary factor motivating these mergers. “Poor financial condition” was the reason for the merger sited by two of the credit unions. “Loss/declining field of membership” was also cited as a reason for the merger by a credit union.

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 10.8%. Four credit unions have net worth ratios below 7.0% and are considered under-capitalized.

The delinquent loans-to-total loans ratio averages 3.6%, which is primarily attributed to three credit unions with delinquency ratios exceeding 5% of loans, including 27% delinquency at $1.3 million asset Quemado CU.

Only five of the 16 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -2.7% and median -0.73% through June of this year.

Below is a chart of the NCUA merger approvals for August 2015:

CEO Advisory Group

CEO Advisory Group