5 Themes – Conversations With CU Leaders

Based on calls we have received over the last month, there is no doubt credit union leaders believe our business will be forever changed after COVID-19.

The thoughts these leaders shared with us can generally be categorized into 5 different themes:

Out of Crises Comes Opportunity. In the true spirit of people helping people, examples abound of credit unions reaching out to help their members in need, such as:

- Mortgage deferral assistance

- Work reduction loans

- Deferred student loans

- Zero minimum payments on credit cards

- No penalty for early redemption of CDs

- Loan relief on auto, credit cards & personal loans

- Grants & assistance to small businesses

- Community giving, such as food to hospital workers

Many credit union memberships are comprised of workers (nurses, grocery workers, firemen, etc.) that are serving our communities in the midst of the pandemic. Going forward, credit unions have great opportunities to create lasting impressions of the unique nature of credit unions by continuing support their members and communities. Obtaining low income designation and/or CDFI certification provides access to grants to further leverage your unique relationship with your members and community in a time of need.

When the Going Gets Tough Credit Unions Take Care of Employees. Credit unions have shared with us the appreciation employees have for their job stability. Many have seen spouses and friends furloughed or terminated in recent weeks; all of them know someone whose hours, salaries, and benefits have been reduced. However, due to the financial strength of credit unions, jobs and salaries are secure. This employment stability and the passion credit unions have for taking care of their employees will certainly not be taken for granted in the years ahead.

Click Here to Download White Paper “Align Member & Executive Interests”

Many CEOs shared that historically they have been reluctant to adopt work at home programs. The silver lining to this crisis is that it has forced an immediate change and so far the adaptation to this new remote work has gone far beyond expectations. Remote work will likely become a key part of the cultural fabric of many credit unions going forward.

Put Your Oxygen Mask on First, Before Helping Others. Economists are predicting either a Great Recession or Great Depression. Fortunately the credit union industry was highly capitalized and profitable going into this unforeseen economic event. Several credit union Execs we have spoken to believe the repercussions for credit unions can be quite severe. Following is some research that supports their insights.

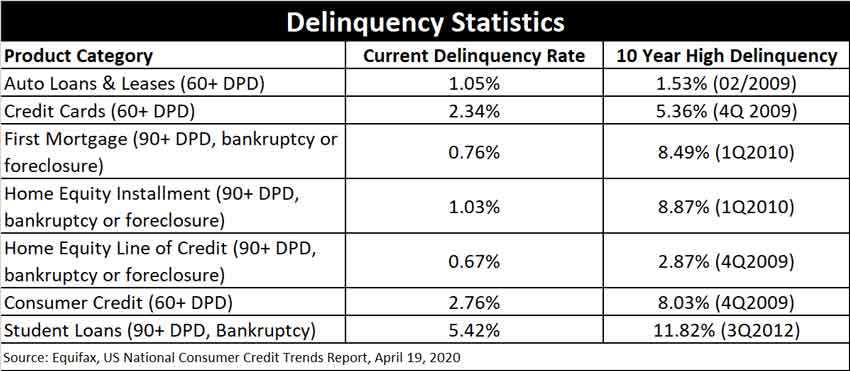

Delinquency & Charge-Offs — As of April 9th, 2020, Equifax reported that the delinquency rate has held steady, even experiencing a slight decline, since February. Yet credit unions should brace themselves for increased delinquency as unemployment soars. Consider Equifax’s reporting of severe delinquencies currently versus 10-year highs resulting from Great Recession:

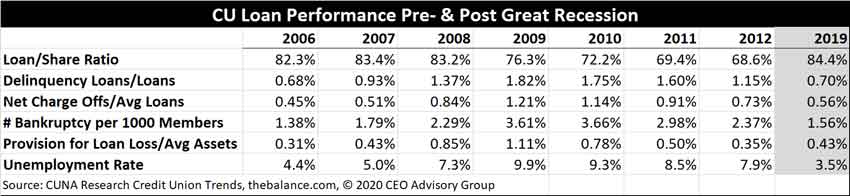

The Great Recession which began in 2008 gives us insight into how credit unions may respond to our current crisis. As shown in the table below, in 2006 the unemployment rate stood at 4.4%. By 2009 it reached its peak of 10%. At year end 2019 unemployment was at a record low 3.5%. At its peak, during the Depression in 1933, the unemployment rate reached 24.9%. According to an April 16th article in Fortune Magazine, the real unemployment rate has already reached 18%, nearly twice the unemployment rate during the Great Recession. The St. Louis Federal Reserve states the unemployment rate could reach 32%, far above the peak of the recession.

CUNA Mutual and CUNA Research report less pessimistic outlooks. In the April 2020 Credit Union Trends Report, CUNA Mutual estimates 2nd Quarter unemployment to exceed 15%. CUNA Economic and Credit Union Forecast, as of April 3rd, 2020 estimates a peak unemployment in the second quarter at 15%, with unemployment dropping to 10% by year end.

Which of these projections will hold true is difficult to tell, but they are clearly a very grim and hopefully the outcome is much better then predicted. Nonetheless a recession/depression of this magnitude will clearly have severe consequences for members and for the financial performance of credit unions.

The chart below illustrates the impact of the Great Recession on credit union loan performance. As unemployment rose from 4.4% in 2006 to a peak of 10% in 2009, bankruptcies and charge-offs nearly tripled. CUNA Mutual projects charge-offs to double due to the Corona Virus.

Credit unions will need to revise their business plans for the months and years ahead. Economics projections and historical data can provide guidance to credit unions as credit union plan for best and worst case scenarios:

- Dropping Loan/share ratios will generate less loan revenue (CUNA Mutual projects 65% Loan/Asset by end of 2020, down from 71% at year-end 2019)

- Net interest margin will decline

- Fee Income dropping as card transaction volume decreases (PSCU reported 32% drop in credit and 12% drop in debit spending for the week ending April 12th compared to previous year)

- Provision for losses more than tripled between 2006 and 2009 to a high of 1.11% (CUNA projects charge-offs of 1.0% in 3rd and 4th Quarter, thereafter settling in at 0.75%)

Let us hope that the monetary and fiscal policies that are being instituted will mitigate the severity COVID-19 will have on our economy.

Best Time to Negotiate is When Financially Strong. Somewhat surprisingly, we have had quite a few credit unions, both large and small, contacting us to discuss mergers during the last few weeks. Naturally, many are concerned about the impact the crisis will have on credit union financial performance as well as on retirement plans in the months and years ahead. These credit unions were primarily wanting to explore a range of options going forward. A general theme was the importance of negotiating a merger from a position of strength as opposed to attempting after the financials deteriorate.

During the great recession, mergers accelerated. In 2007 the credit union industry contracted by 3.1%. In 2008, the first year of the Great Recession, the rate of industry consolidation expanded dramatically to 3.7%, but subsequently leveled. However, in 2012 the rate of consolidation surged again, reaching a peak of 4.2% in 2014. When in the midst of financial uncertainty credit unions are less likely to take on the risk of merging a struggling credit union. Therefore, a number of mergers got delayed until the credit unions financials got stronger.

A New Normal. There is no doubt this crisis will forever change our industry. Members will become more digitally inclined, and member loyalty will be strengthened. Credit unions will rapidly evolve their digital competence. Remote work and board meetings will become commonplace in credit union culture.

Credit union financial performance will be challenged. Yet the groundwork credit unions have laid in diversifying markets and products, and developing economy of scale will enable us to come out of stronger than ever.

CEO Advisory Group

CEO Advisory Group