Credit Union Merger Approvals 3Q 2023

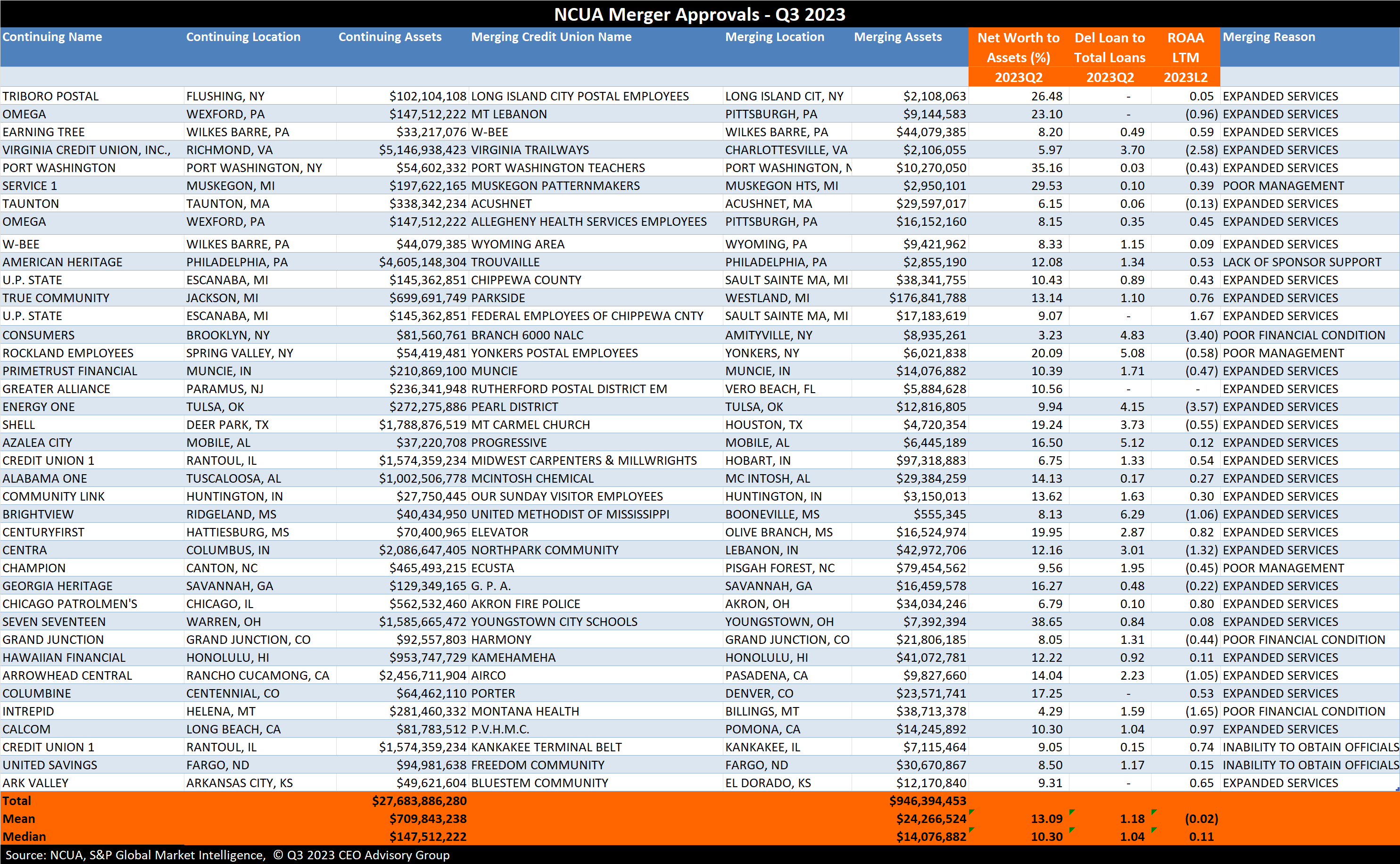

NCUA approved 39 mergers in Q2 of 2023 which increased from 36 last quarter. The combined assets of merged credit unions totals $946M, which compares to $2.7B last quarter and $3.5B in Q3 2022.

The mean and median assets of merged credit unions are $24.3M and $14.1M, respectively.

LARGE CREDIT UNION MERGERS

There was one acquisition of a credit unions with assets exceeding $100 million this quarter. The largest acquisition is:

- Parkside CU, located in Westland, MI is being merged into True Community CU ($700M) in Jackson, MI. Parkside has $177M in assets, 13.1% net worth ratio, 1.1% delinquent loan ratio, and 076% ROAA LTM.

CREDIT UNION MERGER STATS

The median size of acquiring credit unions is $148M. There are 9 credit union acquirers with assets exceeding $1 billion and 14 credit union acquirers with assets below $100M.

With $5.1 billion in assets, Virginia CU is the largest acquiring credit union in Q3.

The acquired credit unions on average represent 3.4% of the assets of the acquiring credit unions.

There is 1 credit union with less than $1 million in assets being acquired. The smallest credit union merger is United Methodist of Mississippi CU based in Booneville, MS with $555,000 in assets.

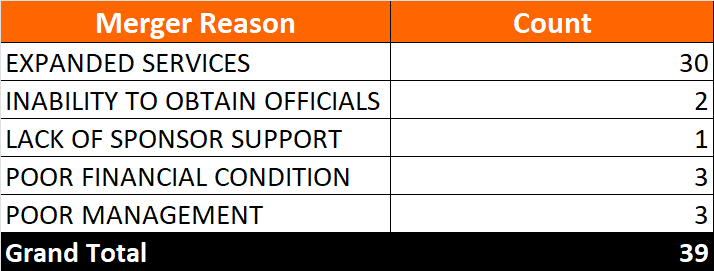

REASONS FOR CREDIT UNION MERGERS

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 33 mergers in Q3, the following reasons were given:

FINANCIAL PERFORMANCE OF ACQUIRED CREDIT UNIONS

The median net worth ratio of the merging credit unions is 10.3%. There are 6 credit unions that have net worth ratios below 7.0%, which is considered undercapitalized.

The delinquent loans-to-total loans ratio averages 1.2%. Sixteen (16) of the 39 merging credit unions reported negative earnings last 12 months. The mean return-on-assets (ROA) was -0.02% and median 0.11% the last twelve months.

Below is a chart of the NCUA merger approvals for Q1 2022:

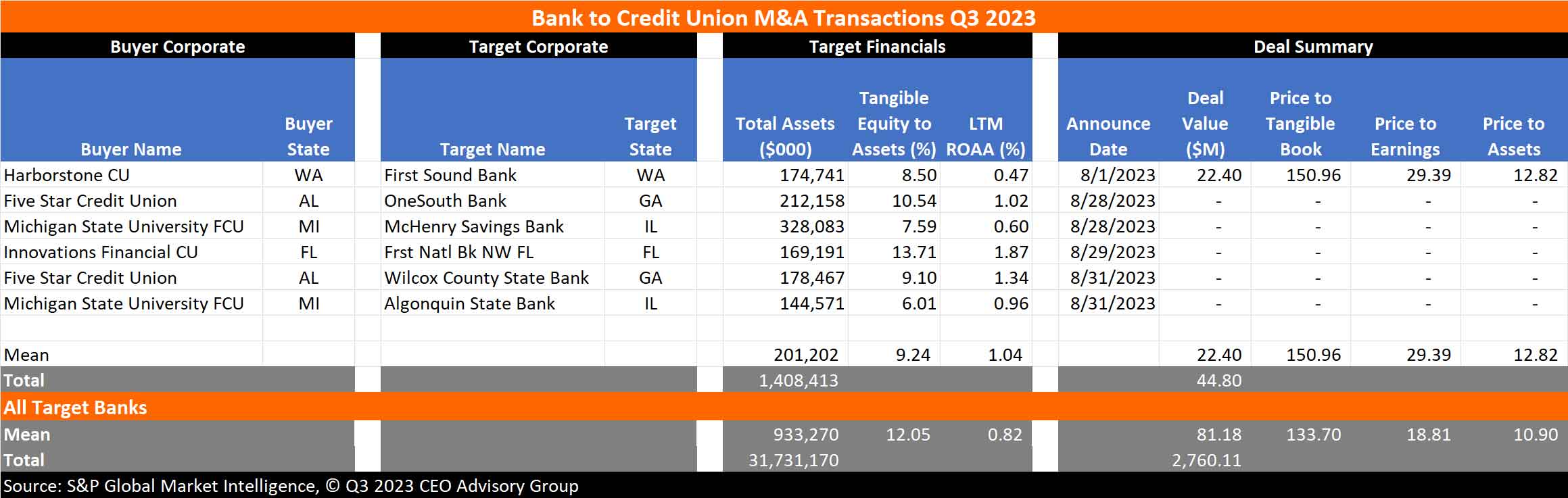

Credit Union Acquisitions of Banks

Bank consolidation was at approximately the same pace as credit union mergers. There was a total of 34 bank acquisitions announced in the third quarter of 2023.

Six of the bank acquisitions were by credit unions. In total these banks had assets of $1.4B, which is 50% more than the combined CUs acquired in the 3rd quarter.

Only one CU announced the deal terms. In August 2023, Harborstone Credit Union announced the acquisition of First Sound Bank, with $175M in assets. The transaction was reported with a Price/Tangible Book of 151% and Price/Earnings multiple of 23.4.3, according to S&P Global Market Intelligence. Among all bank acquisitions reporting deal terms the Price/Tangible Book was 134%.

Among all acquired banks the average ROAA was 0.82% with only 2 reporting a negative ROAA the last twelve months before the announced M&A transaction.

Following is a deal summary of the credit union acquisitions of banks and summary of all bank transactions:

CEO Advisory Group

CEO Advisory Group