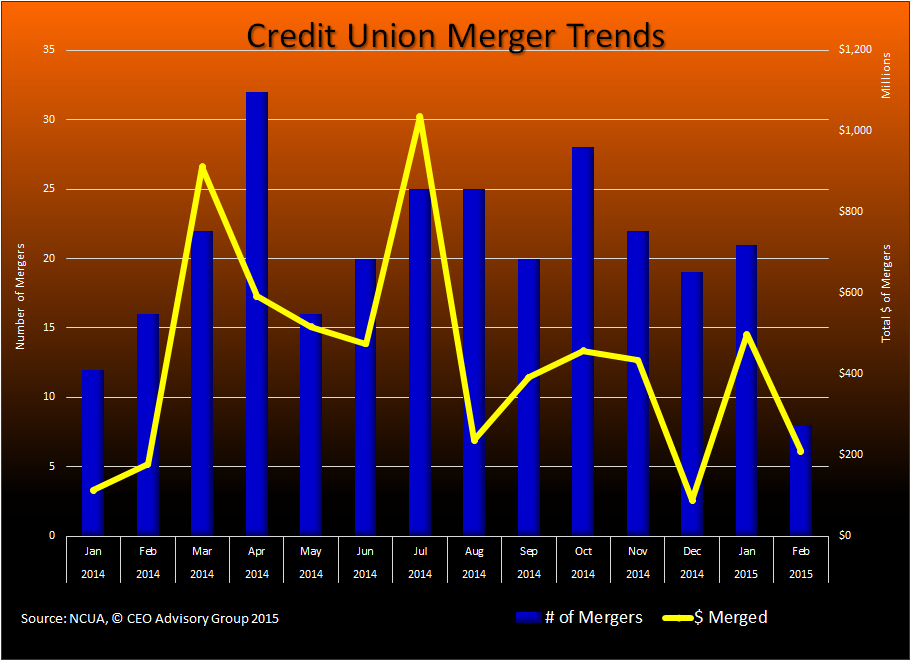

NCUA Approves 8 Mergers in February

The NCUA approved 8 mergers in February 2015 which is half the number of mergers from February of last year. While there were not many mergers, the average size was relatively large compared to most months. The combined assets of the merged credit unions was $210 million. The mean and median assets of merged credit unions are $26 million and $15 million respectively.

Large Credit Union Mergers

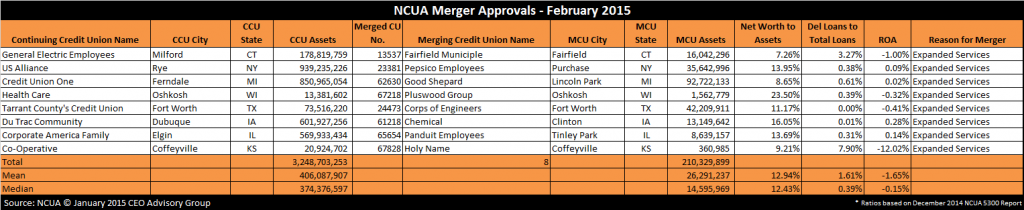

There was one merger where the merged assets exceeded $50 million. The largest merger was $93 million, Lincoln Park, MI based Good Shepard Credit Union which was approved to merge into Credit Union One ($850 million) based out of Ferndale. “Expanded Services is cited as the reason for the merger. Through December Tri-Pointe reported a net worth ratio of 8.7%, delinquency ratio of 0.61% and ROA of 0.02%.

Credit Union Merger Stats

The median size of acquiring credit unions is $374 million. There were no credit union acquirers with assets exceeding $1 billion. With $939 million in assets US Alliance CU, based in Rye, NY, was the largest acquiring credit union in February merging Pepsico Employees CU ($36 million). The acquired credit unions on average represented 6% of the assets of the acquiring credit unions. Nearest in relative size was Corps of Engineers CU with $42 million in assets which represented 57% of the assets of Tarrant County CU. One credit union with less than $1 million in assets is being acquired. The smallest credit union is Holy Name CU based in Coffeyville, KS with $360,000 in assets. Holy Name CU is being acquired by $21 million Co-Operative CU.

Reason for Credit Union Mergers

“Expanded services” continues to be the primary factor motivating these mergers with 100% selecting this as the reason for the merger.

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 12.9%. None of the credit unions have net worth ratios below 7.0%. The delinquent loans-to-total loans ratio averages 1.6%, which is primarily attributed to one credit union with delinquency ratios nearing 8% of loans. Half of the credit unions have positive earnings year to date through December 2014. Consequently the mean return-on-assets (ROA) is -1.65% through December of this year. Holy Names CU heavily influenced the average with a -12% ROA. Below is a chart of the NCUA merger approvals for February 2015:

CEO Advisory Group

CEO Advisory Group