NCUA Approves 19 Mergers in October

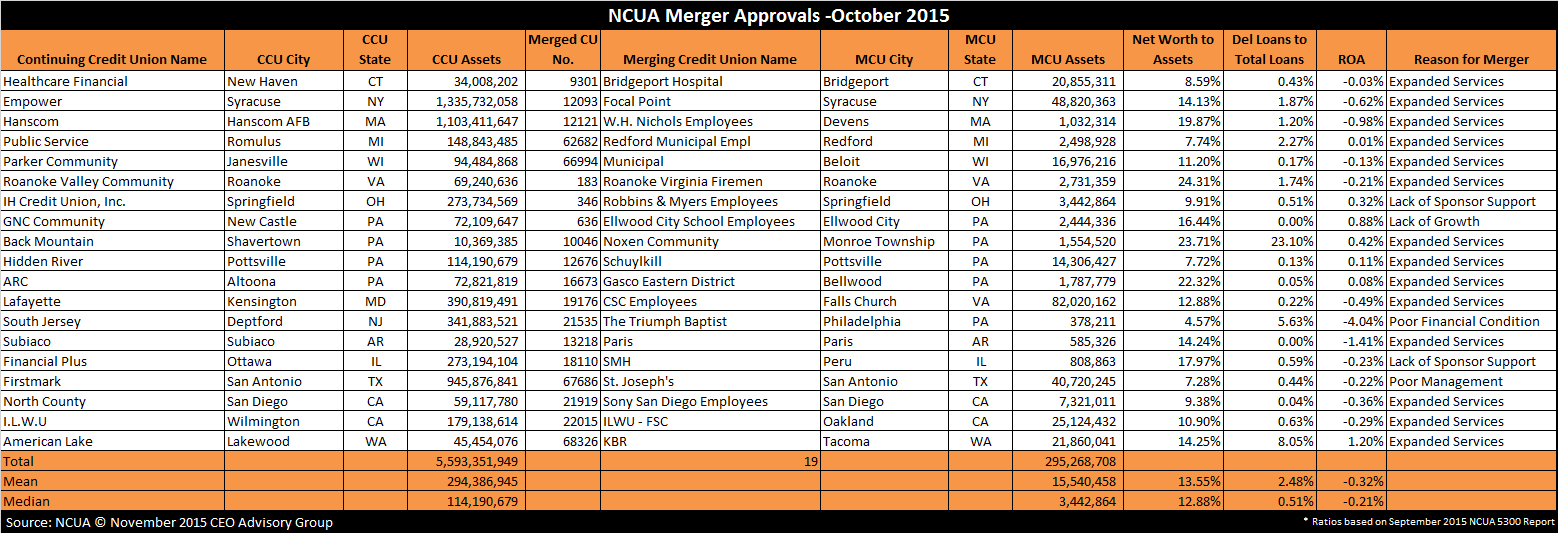

The number of mergers is down compared to last month and year. The NCUA approved 19 mergers in October 2015, which is down from the 28 mergers last month and 28 in October of last year.

The combined assets of merged credit unions is down compared to last month. Total assets of the merged credit unions is $295 million compared to last year’s $458 million. The mean and median assets of merged credit unions are $15.5 million and $3.4 million respectively. In contrast, last month the mean assets were $14.3 million.

Large Credit Union Mergers

There were no acquisitions of credit unions with assets exceeding $100 million this month.

The largest merger was Falls Church, VA based CSC Employees Credit Union ($82M) merging into Lafayette Federal Credit Union ($391M) headquartered in Kensington, MD. CSC Employees CU is well capitalized (12.9%) and has low delinquency (0.2%). ‘We are beyond excited about what this combined credit union will bring to both membership groups,” said LFCU Chairman Norman Cohen. ‘Adding together the capabilities, experience and vision of the financial professionals from the two entities will position us for success for many years to come. We couldn’t be more delighted about this partnership and know it will result in a bigger and absolutely better than ever credit union.”

Credit Union Merger Stats

The median size of acquiring credit unions is $294 million. There are two credit union acquirers with assets exceeding $1 billion.

With $1.3 billion in assets Empower Federal Credit Union, based in Syracuse, NY was the largest acquiring credit union in October merging $49 million Focal Point Credit Union.

Hanscom Federal Credit Union, located at the Hanscom AFB, MA, with $1.1 billion in assets acquired Devens-based W.H. Nichols Employees Credit Union, which has just over $1 million in assets.

The acquired credit unions on average represented 5% of the assets of the acquiring credit unions.

The nearest merger of equals was among New Haven, CT based Healthcare Financial Credit Union ($34M) and Bridgeport-based Bridgeport Hospital Credit Union ($21M).

There are three credit unions with less than $1 million in assets being acquired. The smallest credit union is The Triumph Baptist Credit Union based in Philadelphia, PA with $378,000 in assets, which is being acquired by $341 million South Jersey Credit Union headquartered in Deptford, NJ.

Reasons for Credit Union Mergers

When seeking regulatory approval credit unions are required to site the reason for the merger. Of the 19 mergers in October, the following reasons were given:

- Expanded services: 14

- Lack of sponsor support: 2

- Lack of growth: 1

- Poor financial condition: 1

- Poor management: 1

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 12.9%. Only one credit union had a net worth ratio below 7.0% and is considered under-capitalized.

The delinquent loans-to-total loans ratio averages 2.5%, which is primarily attributed to three credit unions with delinquency ratios exceeding 5% of loans, including 23% delinquency at $1.5 million asset Noxen Community Credit Union.

Only seven of the 19 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -0.3% and median -0.2% through September of this year.

Below is a chart of the NCUA merger approvals for October 2015:

CEO Advisory Group

CEO Advisory Group