NCUA Approved Credit Union Mergers – May 2015

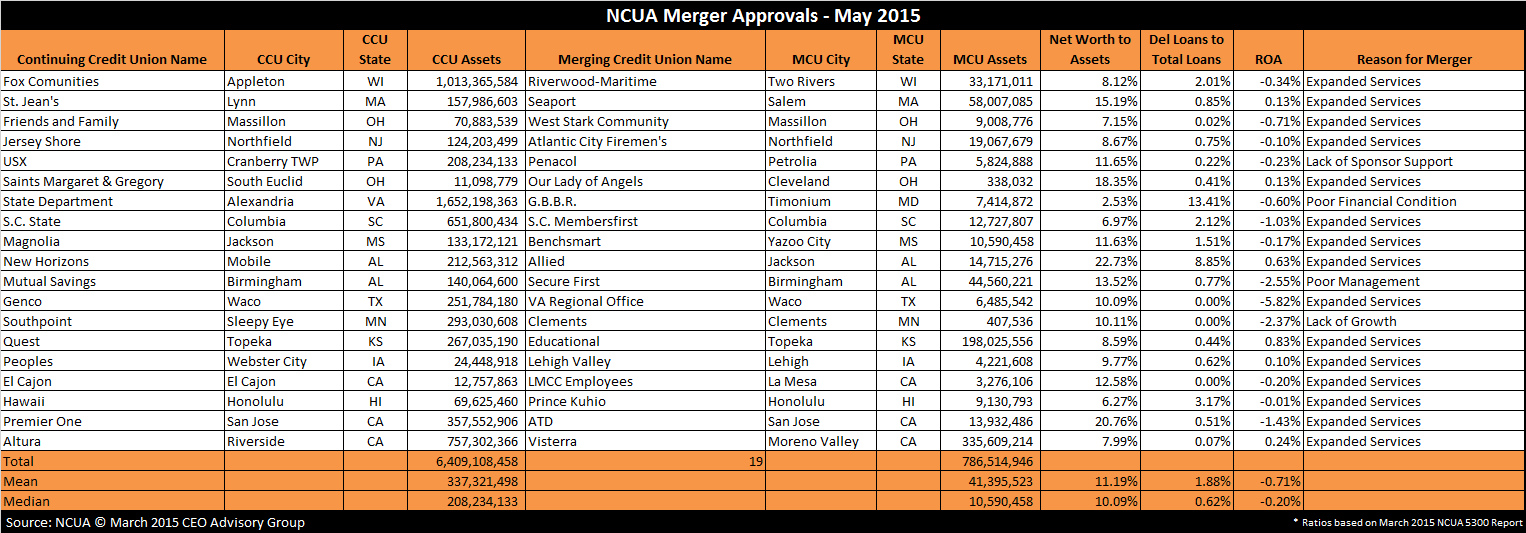

Reversing a trend, the number of mergers is up compared to last year. The NCUA approved 19 mergers in May 2015 which is up from the 16 mergers in May of last year.

Not only were the number of mergers was larger the combined assets was larger. Total assets of the merged credit unions is nearly $787 million compared to last year’s $518 million. The mean and median assets of merged credit unions are $41.4 million and $10.6 million respectively. In contrast, last month the mean assets were nearly $60 million.

Large Credit Union Mergers

There were two mergers with credit unions exceeding $100 million in assets.

The largest merger was Visterra Credit Union’s ($336M) merger into ($329M) Riverside, CA based Altura Credit Union. Both these credit unions showed strong financials. Altura Credit Union will be the surviving charter. Barbara Purvis, Visterra CU Chairwoman, stated in a press release: “Following the major challenges experienced during the “Great Recession”, some of which still linger, Visterra’s Board began exploring opportunities and ideas that would ensure Visterra’s long-term survival in a changed marketplace. A merger with Altura quickly emerged as the best option fr maintaining and improving our range of products and the level of member service that you expect and deserve.”

Topeka, KS based Educational Credit Union ($198M) is merging into Quest Credit Union ($267M) also headquartered in Topeka, CA. The membership has approved the merger with 86% voting in favor. Explaining the merger Quest CEO Vicki Hurt shared “Convenient branch locations aren’t enough anymore. Consumers want convenience delivered straight to them, and that takes electronic services and technology.”

Credit Union Merger Stats

The median size of acquiring credit unions is $208 million. There were two credit union acquirers with assets exceeding $1 billion. With $1.6 billion in assets State Department Credit Union, based in Alexandria, VA was the largest acquiring credit union in May merging $13 million S.C. Members First Credit Union. Appleton, WI based Fox Communities Credit Union, which is merging Two Rivers-based Riverwood-Maritime Credit Union with $33 million in assets, was the second largest acquirer with $1.0 billion in assets.

The acquired credit unions on average represented only 12% of the assets of the acquiring credit unions.

There was one merger of equals between Educational Credit Union and Quest Credit Union.

Two credit unions with less than $1 million in assets are being acquired. The smallest credit union is Our Lady of Angels CU based in Trenton, NJ with $338,000 in assets, which is being acquired by $11.1 million Saints Margaret & Gregory CU.

Reasons for Credit Union Mergers

“Expanded services” continues to be the primary factor motivating these mergers. “Poor financial condition” was the reason for the merger sited by one of the credit unions. “Lack of sponsor support” was also cited as a reason for the merger.

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 10.1%. Three credit unions have net worth ratios below 7.0%.

The delinquent loans-to-total loans ratio averages 1.9%, which is primarily attributed to wot credit unions with delinquency ratios exceeding 5% of loans. This includes the 13% delinquency ratio reported by G.B.B.R Credit Union.

Only six of the 19 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -0.7% and median -0.2% through March of this year.

Below is a chart of the NCUA merger approvals for May 2015:

2 Comments on “NCUA Approved Credit Union Mergers – May 2015”

CEO Advisory Group

CEO Advisory Group

Pingback: 5 Ways to Motivate Employees During a Credit Union Merger

Pingback: NCUA Credit Union Merger Approvals June 2015