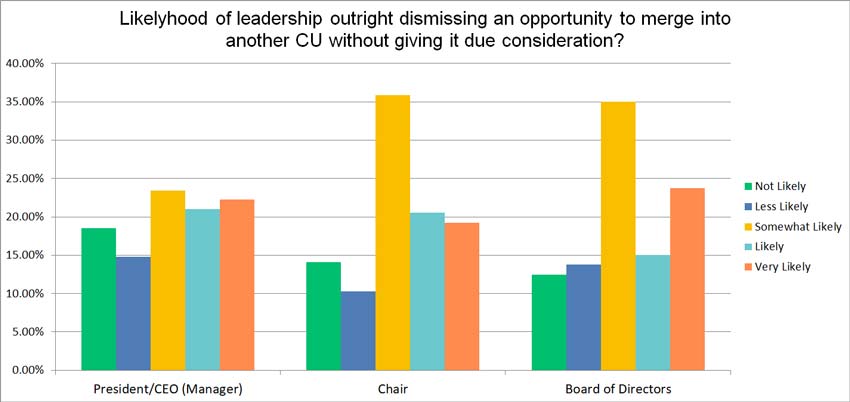

Mergers Dismissed Without Consideration

When a credit union is faced with a merger, it’s also faced with the ability to strategically align itself against competing for financial institutions. Mergers enable credit unions to incorporate the best technologies for both their employees and members, offer the best possible loan rates, and expand their footprints in a way that’s more convenient to their members. Of course, there are many other benefits, too. So, with all of these positives, who would possibly dismiss a merger without consideration? (see video, Is Now the Right Time for a Merger?)

Let’s explore the results of a study commissioned by CEO Advisory Group that addresses this very question.

Board of Directors

35% of respondents to the study indicated that their boards of directors were somewhat likely to dismiss a merger opportunity outright without giving it due consideration. Another 24% said their boards were very likely to do so. Only 12.5% of respondents indicated their boards were not likely to dismiss a merger possibility, meaning they’ll probably weigh possible benefits and deficits, should a potential merger partner surface.

Chair

36% of survey respondents indicated the chair was somewhat likely to dismiss a credit union merger without giving it due consideration, making it the highest possibility of all the options, according to those who answered.

The numbers were still high for chairs to be likely and very likely to dismiss potential mergers, with 40% of people indicating their chairs would fall into one of these categories. 14.1% of people said their chairs were not likely to dismiss potential merger partners without proper inspection of the proposal, which is a better outcome than the 12.5% of boards of directors who fell into the same category.

President/CEO (Manager)

Interestingly, the results for the various categories were similar across the board when the question came to the president or CEO.

Over 43% of respondents indicated their CEOs were not likely or less likely to dismiss a merger without due consideration. That means nearly half of CEOs and presidents are willing to give the process it requires to ensure their members, employees, and overall communities are taken care of and will consider mergers if that action is best for everyone at stake.

On the other hand, 23.5% of people indicated their presidents or CEOs were somewhat likely to dismiss the proposition without fully exploring the benefits and deficits. This number is significantly less than those of the chair and board of directors, which seems to indicate people aren’t as sure of what their chairs and boards would do as they are with their CEOs’ decisions.

Respondents indicated about an even number of presidents and CEOs were likely or very likely to dismiss a merger without due consideration, with an average count between the two coming in at just under 22%,

To learn more about the leaders who are likely to dismiss mergers without consideration, as well as other valuable information gained from the study, download CEO Advisory Group’s white paper When Prospective Partners Come Knocking: Credit Union Board and Management Responsibilities to Consider Merger Proposals.

CEO Advisory Group

CEO Advisory Group