How Receptive Is Credit Union Leadership to a Merger?

In the world of credit unions, mergers are an essential part of growing and staying relevant. In fact, a well-planned merger can actually help you gain a significant competitive advantage. With that said, it seems some leaders are resistant to the idea of mergers for a variety of reasons—maybe they don’t have adequate suitors, or perhaps they think they can withstand the changes in the industry by keeping with the status quo. Of course, neither of these excuses—or the many others that exist—is a positive strategy if you want your organization to continue succeeding.

By the Numbers

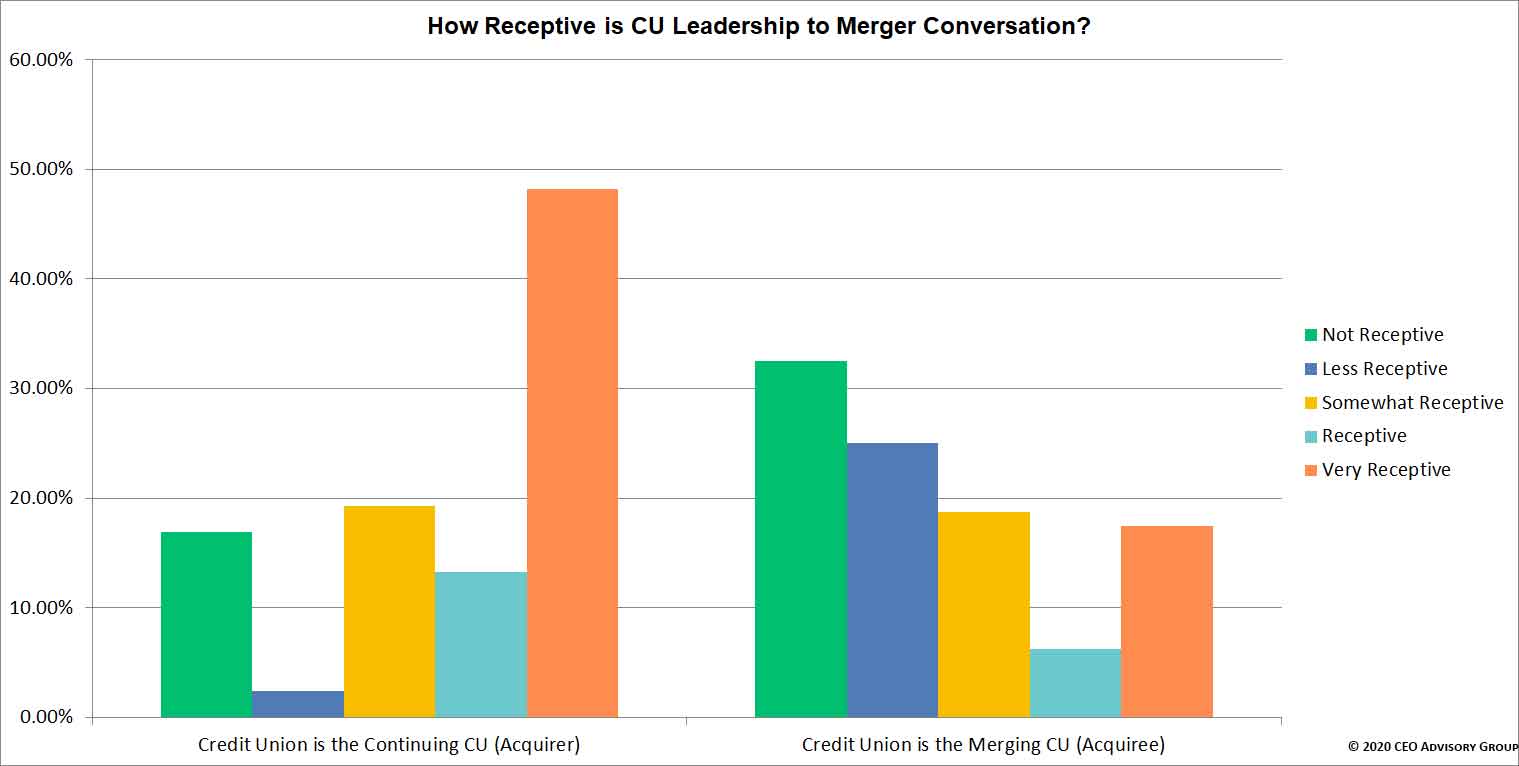

According to survey results in a study recently conducted by CEO Advisory Group, credit union leaders of organizations of all sizes are generally receptive to the idea of mergers. In fact, 48.2% of leaders are very receptive to the idea of merging if they’ll be the continuing CU (acquirer), while 17.5% of leaders are very receptive to the idea of being acquired.

Among credit unions that could potentially become the acquiree, the greatest number of respondents were not receptive to the idea, however. 32.5% of the respondents were disengaged from the idea. Perhaps that’s because they’re already operating successful organizations, or perhaps it’s because they don’t fully understand the benefits that can result from a well-executed merger.

In the middle of the pack, approximately 20% of respondents noted they’d be receptive to a merger on either side of the field, both as acquirers and acquirees. This, of course, would be contingent upon the benefits to be gained for both parties, but with one in five respondents being open to the idea of a merger, this certainly makes a case for the ever-changing landscape of the credit union industry.

What the numbers do tell us is that leaders tend to be on different sides of the fence when the discussion of mergers comes around, generally speaking. While about the same percentage of respondents were somewhat receptive to the idea of a merger, the numbers vary greatly on either side of that question. While nearly one-third of respondents were not receptive at all to being acquired in a merger, only about 17% were not interested in a merger if they would be the acquiring party.

Addressing the Concerns

Despite the overwhelming changes in the credit union industry in recent decades, some leaders are understandably concerned about merging with another financial institution. The fear of the unknown exists with regard to how the changes will affect their employees, their overall operations, and most importantly, their members.

Naturally, one must weigh both the benefits and downsides before considering entering into a merger. Do mergers create value for members? Sure they do, but only if they’re assessed and carried out correctly.

For starters, credit unions generally tend to have like-minded customer service missions and overall visions. This means the acquiring CU will likely want to take care of your members in the best way possible, just as your current organization does.

Another element to consider is your financial situation; in particular, if your credit union is currently in a struggling monetarily, a merger might be the only way to protect your members and continue to provide them with the technology, service, and rates with which they’ve become accustomed.

According to the NCUA:

The financially troubled credit union that does find a merger partner has less standing to negotiate terms of the merger agreement that could benefit the credit union’s members, staff, and officials.

In other words, the better your financial position, the better your ability to negotiate with potential merger partners. It’s important to consider this as a possibility before you find yourself in an upside-down position because waiting too long can diminish your ability to make demands that coincide with your current strategies and services.

Considerations Regarding a Potential Credit Union Merger

Given that around this time last year, NCUA approved 31 mergers with combined assets of $2.1 billion, there’s certainly cause to say leaders are generally receptive to the idea of mergers. This is because mergers enable credit unions to:

- Expand their services

- Overcome poor financial situations

- Obtain officials

- Grow

- Sustain or gain membership

With all this on the table, the decision to merge still isn’t something you should weigh lightly. The following are a few key pieces under which firm consideration should be taken before committing to a merger:

1. Culture Fit

It’s important to consider a merger partner that offers the same long-standing values, beliefs, and processes that represent your own organization. This will ensure your customers, both internal and external, will be as minimally affected by forthcoming changes as possible.

2. Member Retention

Credit unions that have different member charters—even if all else is perfectly aligned—could wind up with declining memberships. It’s important to understand at the forefront that members of each organization can slide seamlessly into the new structure without disrupting the existing charters.

3. Regulations

Did you know that the NCUA must approve all transactions based on the following criteria?

- The merger or acquisition is in the best interest of the members

- It’s in line with the requirements of the Federal Credit Union Act, the NCUA’s rules and regulations, and the IRPS 03-1

- It minimizes risk to the NCUSIF

There are many hurdles in the merger process. In future articles we will be sharing further insights on CU leaders’ perspectives on the most significant obstacles to a merger.

Download whitepaper: When Prospective Partners Come Knocking

CEO Advisory Group

CEO Advisory Group