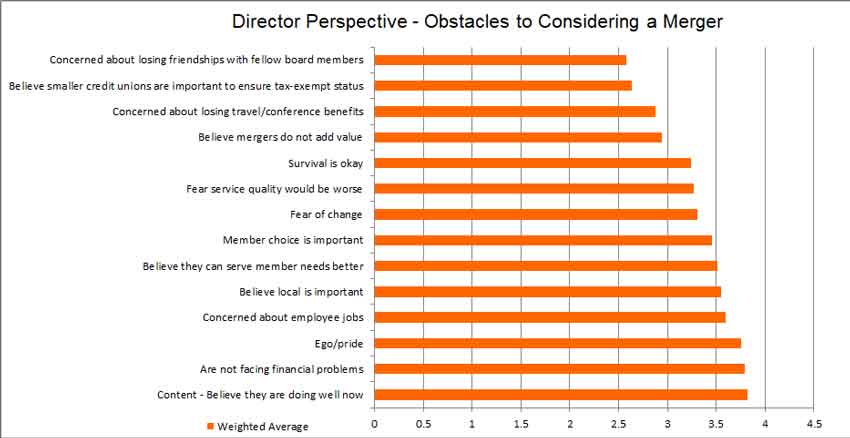

Director Perspective – Obstacles to Mergers

We all know credit union mergers have become more and more common in recent decades. With this, however, there are still many leaders who aren’t sold on the idea. What merger obstacles are standing in the way of their potential decisions to become one with other organizations?

According to a study commissioned by CEO Advisory Group, CU boards of directors consider a range of obstacles, including contentment with their current status quos all the way to being concerned about losing friendships with their fellow board members. With this in mind, let’s take a deeper look at the study’s findings and why leaders aren’t interested in considering mergers.

Contentment: They Believe They’re Doing Well Now

The overwhelming majority of survey respondents indicated they believe they’re doing well at the present time, and as such, don’t feel the need to consider a merger. While it’s great that so many organizations are doing so well, this might not be the best way to look at the merger picture. While credit union mergers often enter the picture when CUs begin to experience declining or stagnant membership, suffer compliance issues, or have financial troubles, the fact is, CUs actually have more negotiating leverage when they’re healthy and prosperous.

If you wait until you’re in a bind, you’ll be giving your pursuing partner the upper hand.

They’re Not Facing Financial Problems

This point goes along with the prior point. Almost an identical number of respondents indicated they’re not interested in considering a merger because they’re not facing financial difficulties. Over 36% of those surveyed indicated this point is very influential as a reason they don’t need to merge with another organization.

Again, when a credit union is on the decline and facing financial problems, it begins to have less leverage in the negotiating process. The right time to avoid unnecessary merger obstacles is when your credit union is healthy and vibrant.

Ego and Pride Take Over the Process

Time and time again, we see that ego and pride are two merger obstacles that stand in the way of growth and success for credit unions. Leaders sometimes see themselves as failures if they can’t maintain their organization as it is, but the real failure would be missing out on an opportunity to provide members and employees with the benefits that can be obtained from a merger, including:

- Better technology

- Lower loan rates

- Higher savings rates

- Greater footprints

As part of credit union leaders’ fiduciary duties, they must consider the best interests of the membership. Despite ego and pride, if a pursuing credit union can offer benefits your organization cannot offer without a merger, it is imperative to at least consider the options that could be afforded to the community by way of a merger.

They’re Concerned About Employee Jobs

This is a noble cause, and it’s one that does require serious consideration. Good leaders want to ensure their employees are well taken care of, and in the uncertainty of a merger, this can be a cumbersome subject. In reality, this is one of the merger obstacles that often ends up being a myth, as the right negotiations can ensure everyone has a seat at the table, so to speak.

More than half of respondents (56.7%) indicated their concern for employees’ jobs is either influential or very influential to their hesitation about mergers. However, thanks to economies of scale, what typically ends up happening is that everyone is able to focus on their unique skill sets without feeling stretched in a bunch of different directions.

If you’re interested in learning more about the information uncovered in CEO Advisory Group’s study, download our free white paper and learn what your peers think about mergers.

CEO Advisory Group

CEO Advisory Group