Credit Union Mergers – July 2016

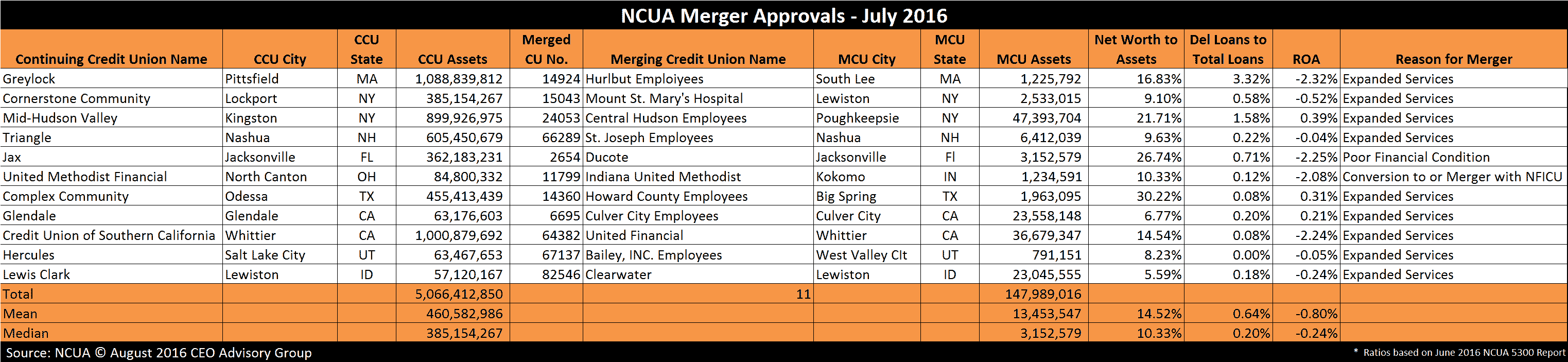

NCUA approved 11 mergers in July 2016 which has decreased from 16 last month.

The number of mergers are down and the combined assets of merged credit unions are also down nearly $77 million compared to last month. For the month of July, the total merged assets are significantly down to $148 million compared to last year’s $514 million. That’s a difference of $366 million. The mean and median assets of merged credit unions are down to $13.5 million and $3.2 million respectively.

Large Credit Union Mergers

There were no acquisitions of credit unions with assets exceeding $100 million this month.

The largest merger was Poughkeepsie, NY based Central Hudson Employees Credit Union ($47M) merging into Mid-Hudson Valley Credit Union ($900M) headquartered in Kingston, NY. United Financial is well capitalized (15% Net Worth), has low delinquency (0.08%) and is losing money (-2.24% ROA). “Expanded Services” was given as the reason for the merger.

Click Here to Download White Paper “How Mergers Help Small CUs”

Credit Union Merger Stats

The median size of acquiring credit unions is $385 million. There are 2 credit union acquirers with assets exceeding $1 billion.

With $1.1 billion in assets Greylock Credit Union, was the largest acquiring credit union in July.

Other credit union with assets exceeding $1 billion included:

- Credit Union of Southern California, Whittier, CA (Just over $1.0B)

The acquired credit unions on average represent 3% of the assets of the acquiring credit unions.

The nearest merger of equals is:

Lewiston, ID based Lewis Clark Credit Union ($57M) and Lewiston, ID based Clearwater Credit Union($23M). Clearwater represents 40% of Lewis Clark’s assets.

There is one credit union with less than $1 million in assets being acquired. The smallest credit union is Bailey, INC. Employees Credit Union based in West Valley City, UT with $791,000 in assets, which is being acquired by $63 million in assets Hercules Credit Union headquartered in Salt Lake City, UT.

Reasons for Credit Union Mergers

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 11 mergers in July, the following reasons were given:

- Expanded services: 9

- Poor financial condition: 1

- Conversion to or Merger with NFICU: 1

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 10.3%. Two credit unions have a net worth ratio below 7.0% and are considered under-capitalized.

The delinquent loans-to-total loans ratio averages 0.6%.

3 of the 11 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -0.80% and median -0.24% for July of 2016.

Below is a chart of the NCUA merger approvals for July 2016:

CEO Advisory Group

CEO Advisory Group