The Squeeze On Small Credit Unions

There was a time when a quaint, small credit union could compete with the bigger organizations in town. In simpler times, things were a lot different; however, today’s ultra-competitive credit union economy relies on economies of scale in order for credit unions to keep up with member expectations and maintain an aggressive position in the marketplace.

Define a ‘Small’ Credit Union

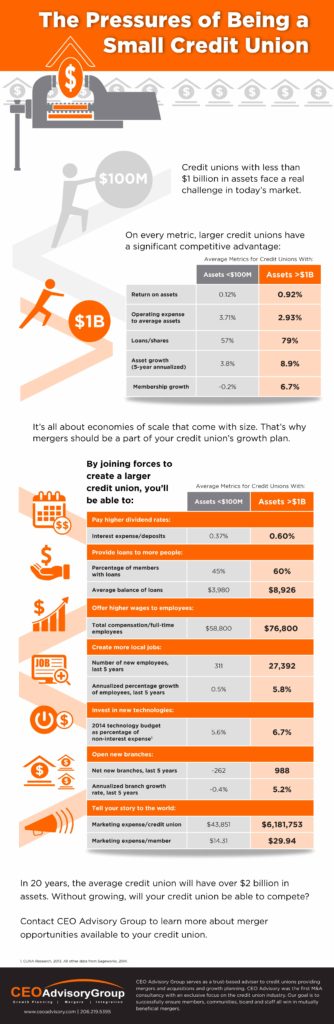

In today’s world, credit unions with less than $100 million in assets are at a severe disadvantage in many ways. That said, $1 billion is rapidly becoming the baseline asset figure for truly successful and competitive credit unions. This means, in most cases, a small credit union would be one that does not have at least $1 billion in assets.

Weighing The Metrics

On every metric, larger credit unions have a significant competitive advantage over smaller credit unions. This infographic places some imperative information for both small and large credit unions side by side, allowing for easy digestion of the numbers.

By comparison, credit unions with assets of $1 billion or greater are substantially earning more positive marks across the board.

Here’s a look at a couple of key metrics: The Pressures of Being a Small Credit Union.

- Membership Growth: Decline vs. Increase

On average, credit unions with assets of at least $1 billion are currently enjoying an annual membership growth around 6.7% year after year.

Conversely, small credit unions are unable to enjoy such positive growth; they’re actually experiencing a decline in membership growth around -0.02% each year.

- Operating Expense: More is Less

One of the key metrics to measure economies of scale in the credit union world involves the ratio of operating expense to average assets.

Larger credit unions, although they incur greater operating expenses, are in much more advantageous positions than their small credit union counterparts on a percentage basis. When all else is equal, the larger credit union simply has a greater economy of scale, while smaller credit unions are left to absorb the same or higher costs without the cushion.

Reinvestment drives growth. Credit unions with over $1 billion are able to re-invest more in their credit unions, both as a percent of expenditures and as a dollar amount. Credit union under $100 million do not have the efficiences to re-invest at the same rate. The different rates of growth reflect a smaller credit union’s reduced ability to re-invest in itself.

Putting the numbers to it, big credit unions hold an operating expense to average assets ratio of about 2.93%. Meanwhile, small credit unions are measuring in with about 3.71% on the same ratio.

Employees, Members, & Communities: Can Small CUs Compete?

The numbers overwhelmingly indicate that small credit unions aren’t able to provide the same experience larger credit unions can.

- Members of large organizations receive lower loan interest rates and higher dividends on interest-bearing accounts.

- Employees typically enjoy much higher wages at large credit unions. Bigger institutions are also more capable of creating and growing jobs in their markets than smaller credit unions.

- Members have access to better technology and more branches when they belong to credit unions with ample assets.

In 20 years, the average credit union will have over $2 billion in assets. For small credit unions that are already feeling the crunch, leaders are wise to create strategic growth plans that take all possible future outcomes into account, including positioning the organization such that it will be highly sought after when competing credit unions are seeking merger partners.

The smaller the organization, the greater the limitation that credit unions can offer their members, employees, and communities. As economies of scale come into play, bigger credit unions are simply able to offer more benefits. For a small credit union that wants to compete optimally in the market, a merger can help the organization’s leaders realize the advantages that can be obtained from economies of scale.

CEO Advisory Group

CEO Advisory Group