Credit Union Merger Approvals – September 2018

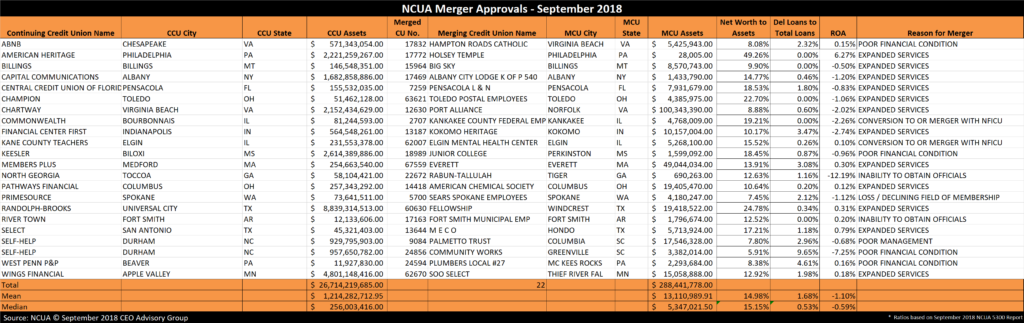

NCUA approved 22 mergers in September 2018 which increased from 16 last month. The combined assets of merged credit unions is $288M, which compares to $1.4B last month and $392M a year ago.

The mean and median assets of merged credit unions are $13.1M and $5.3M, respectively

LARGE CREDIT UNION MERGERS

There were two acquisitions of a credit unions with assets exceeding $100 million this month.

The largest was PortAlliance located in Norfolk, VA, acquired by Chartway headquartered in Virginia Beach, VA. Mill City is well capitalized (8.8% Net Worth), low delinquency (0.6%), and unprofitable (-2.02%).

Click Here to Download White Paper “Align Member & Executive Interests”

CREDIT UNION MERGER STATS

The median size of acquiring credit unions is $256 million. There are 5 credit union acquirers with assets exceeding $2 billion.

With $8.8 billion in assets, Randolph-Brooks was the largest acquiring credit union in September.

The other continuing credit unions with assets exceeding $1 billion were:

- American Heritage ($2.2B)

- Chartway ($2.2B)

- Keesler ($2.6B)

- Wings Financial ($4.8B)

The acquired credit unions on average represent 1% the of the assets of the acquiring credit unions.

The nearest merger of equals is:

McKees Rocks, PA based Plumbers Local #27 ($2.3M) merging into West Penn P&P ($11.9M) headquartered in Beaver, PA.

There are two credit unions with less than $1 million in assets being acquired. The smallest credit union is Holsey Temple based Philadelphia, PA with $28,000 in assets, which is being acquired by $2 Billion in assets American Heritage headquartered in Philadelphia, PA.

REASONS FOR CREDIT UNION MERGERS

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 22 mergers in September, the following reasons were given:

- Expanded Services: 12

- Poor Financial Condition: 4

- Poor Management: 1

- Inability to Obtain Officials: 2

- Loss/Declining Field of Membership: 1

- Conversion to or Merger with NFICU: 2

FINANCIAL PERFORMANCE OF ACQUIRED CREDIT UNIONS

The median net worth ratio of the merging credit unions is 15.15%. There is one credit union that has a net worth ratio below 7.0%, which is considered undercapitalized. Worst was Community Works credit union which had a 5.91% net worth ratio.

The delinquent loans-to-total loans ratio averages 1.68%

Ten (10) of the 22 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) was -1.10% and median -0.59% for September of 2018. Below is a chart of the NCUA merger approvals for September 2018:

CEO Advisory Group

CEO Advisory Group