Credit Union Merger Approvals – July 2017

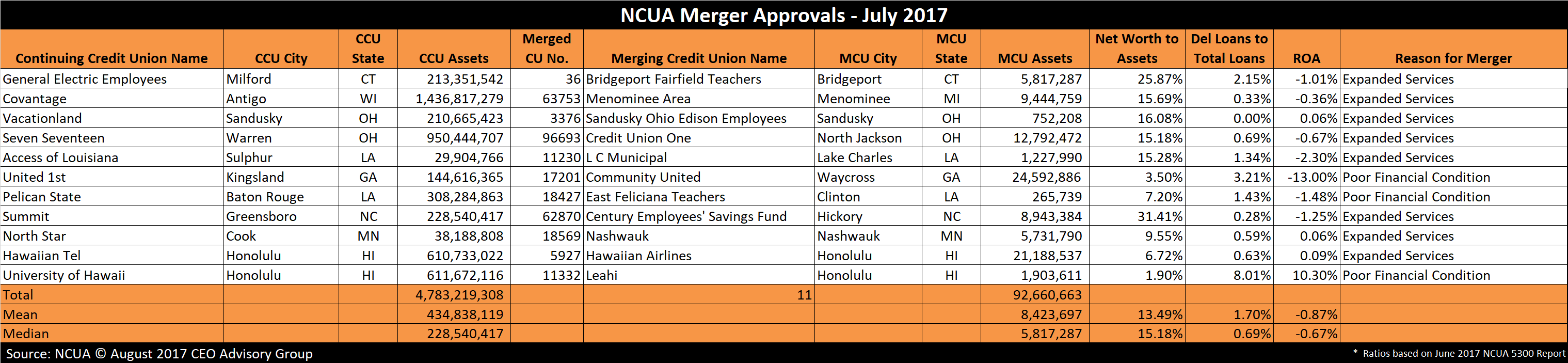

NCUA approved 11 mergers in July 2017 which decreased from 21 last month. The number of mergers are down and the combined assets of merged credit unions are down nearly $385M compared to last month. For the month of July, the total merged assets are down, $93 million compared to last year’s $148 million. That’s a difference of $55 million. The mean and median assets of merged credit unions are $8.4 million and $5.8 million respectively.

Large Credit Union Mergers

There wasn’t an acquisition of a credit union with assets exceeding $100 million this month.

The largest merger was Waycross, GA based Community United Credit Union ($25M) merging into United 1st Credit Union ($145M) headquartered in Kingsland, GA. Community United Credit Union is poorly capitalized (3.50% Net Worth), has high delinquency (3.21%) and high losses (-13.00% ROA). “Poor Financial Condition” was given as the reason for the merger.

Click Here to Download White Paper “From Discovery to Integration”

Credit Union Merger Stats

The median size of acquiring credit unions is $229 million. There is one credit union acquirer with assets exceeding $1 billion.

With $1.4 billion in assets, CoVantage Credit Union was the largest acquiring credit union in July.

The acquired credit unions on average represent 2% the of the assets of the acquiring credit unions.

The nearest merger of equals was Waycross, GA based Community United Credit Union ($25M) merging into United 1st Credit Union ($145M) headquartered in Kingsland, GA. There are 2 credit unions with less than $1 million in assets being acquired. The smallest credit union is East Feliciana Teachers Credit Union based in Clinton, LA with $265,739 in assets, which is being acquired by $308.3 million in assets Pelican State Credit Union headquartered in Baton Rouge, LA.

Reasons for Credit Union Mergers

When seeking regulatory approval credit unions are required to cite the reason for the merger. Of the 11 mergers in July, the following reasons were given:

- Expanded Services: 8

- Poor Financial Condition: 3

Financial Performance of Acquired Credit Unions

The median net worth ratio of the merging credit unions is 15.18%. Two credit unions have a net worth ratio below 7.0% and are considered under-capitalized.

The delinquent loans-to-total loans ratio averages 1.7%

Four of the 11 of the merging credit unions reported positive earnings year to date. The mean return-on-assets (ROA) is -0.87% and median -0.67% for July of 2017.

Below is a chart of the NCUA merger approvals for July 2017:

CEO Advisory Group

CEO Advisory Group