Branches aren’t dead yet, invigorate your growth with mergers

Chances are growth strategies will once again be the central topic of discussion at your strategic planning session this autumn. You’ve heard the prediction “branches are dead”. Stats show markets are over-branched. Banks are closing branches at a record rate. Yet you look at the numbers and see your market penetration and product utilization is highly correlated with proximity to your branch locations.

Perhaps you’ve seen your members taking new jobs and relocating to surrounding neighborhoods or towns. Growth has stagnated at your primary SEG or the community you serve, yet there are abundant opportunities in neighboring markets to serve existing members and generate new member relationships. There is excitement among the board members to pursue these opportunities. But then the economic reality of this investment opportunity comes into play and these planning session dreams vanish into thin air.

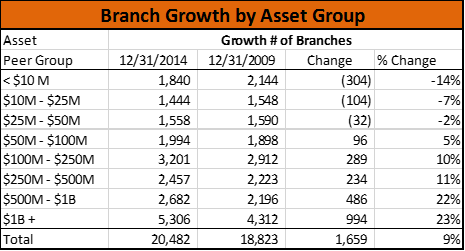

The challenges facing the vast majority credit unions are illustrated in the numbers. Since 2009 credit unions have grown their branch network by 1,659 bringing the total 20,482 branches. Credit unions over $1 billion contributed to 60 percent to the growth. In contrast credit unions below $50 million in assets experienced a net loss of 440 branches.

The credit union balance sheet and income statement help explain the differences in strategy. Of course as credit union leaders you recognize the disparity in strategy between large and small credit unions driven by resources, branching expertise and capacity for risk taking. This disparity is illustrated in the financial ratios to follow.

Large credit union investment in land & building outpaced smaller- and medium-sized credit unions over the last five years. Two-thirds of credit unions over $500 million increased the book value of their investment in land and facilities. Similarly among medium-sized credit unions in the $250 – $500 million asset category over half expanded their investments. The investments for smaller credit unions was significantly less with 80% reducing or maintaining existing land & building investment.

It is interesting to note that despite their significantly higher rate of branch expansion, the $1 billion plus credit unions tend of have a smaller portion of assets tied up in land & building, with the majority having a land & building to asset ratio below 2%. As show in the table below the smallest credit unions often enjoy the benefit of sponsored space, however this can be both a blessing and a curse. Sponsored space can, for some credit unions, be an anchor on their growth.

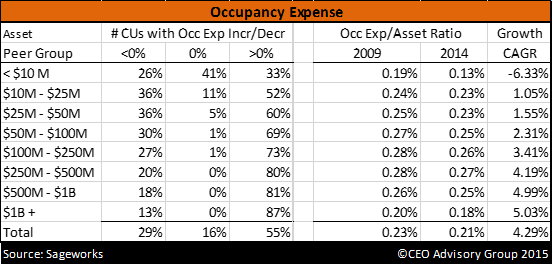

Credit unions have been growing their occupancy expense at 4.3% per year. At the same time the occupancy expense/asset ratio has dropped 2 basis points over the last five years. As expected, growth in occupancy expense was correlated with asset size. Small- and mid-sized credit unions were constrained in their occupancy expenditures. In the last five years over half (55%) of all credit unions increased occupancy. Credit unions over $250 million invested significantly more in occupancy expenses.

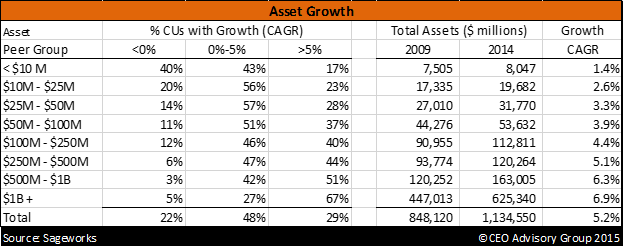

Over the last few years there has been a great deal of debate about the role of branches in the future of credit unions. For now we continue to see the investment in facilities continues to be highly correlated with growth. As shown in the table below the annualize growth for credit unions under $100 million in assets has been below 4%. In contrast credit unions over $500 million have annualized growth exceeding 6%. Similarly over half of large credit unions have assets growth exceeding 5% annually. Interestingly, when examining credit unions that have experienced declining assets the last five years we see double digit declines among peer groups below $250 million.

Branches will likely continue to play an important role in credit union growth in the foreseeable future. Many markets are considered over-branched. The cost of entering a new market highly expensive and cost prohibitive for many smaller- and medium-sized credit unions.

With the changing market dynamics and branching economics, mergers should be a strategy both large and small credit unions should consider. Branch network expansion is a key part of the value proposition for most credit union mergers. A merger enables the members of the acquired credit union to instantaneously gain access the convenience of a broader branch network. Occasionally, the merger deal points include building a new branch that is mutually beneficial to both credit unions. A merger benefits the acquiring credit union’s ability to expand its branch infrastructure to serve new and existing members in a cost effective manner. Collaborating in this way provides economic and competitive benefits to both sides. Members benefit. Employees benefit. The community benefits.

Mergers among credit union is one of the greatest, if not the greatest, strategic competitive advantages we have as an industry.

Note: This article was originally published on cuinsight.com.

1 Comments on “Branches aren’t dead yet, invigorate your growth with mergers”

CEO Advisory Group

CEO Advisory Group

Pingback: The Challenge Of Keeping Up With Credit Union Member Expectations